Is

Bitcoin Ready for Its Next Leg Up? Here’s

What We Know So FarBitcoin

BITSTAMP:BTCUSD is so back — not

just back like “we recovered the

dip,” but back like “new all-time

highs, let’s go shopping for Lambos

on moons” back.

If you’ve been following our Top

Stories coverage, you’ll know that

the OG token vaulted past $109,500

last week, then kissed

$11

The best trades require research, then commitment.

Free Premium plans 14 day$0 forever, no

credit card needed

Scott "Kidd" PoteetThe unlikely astronaut

Where the world does markets

Join 100 million traders and investors taking the future into their own hands.

Explore features

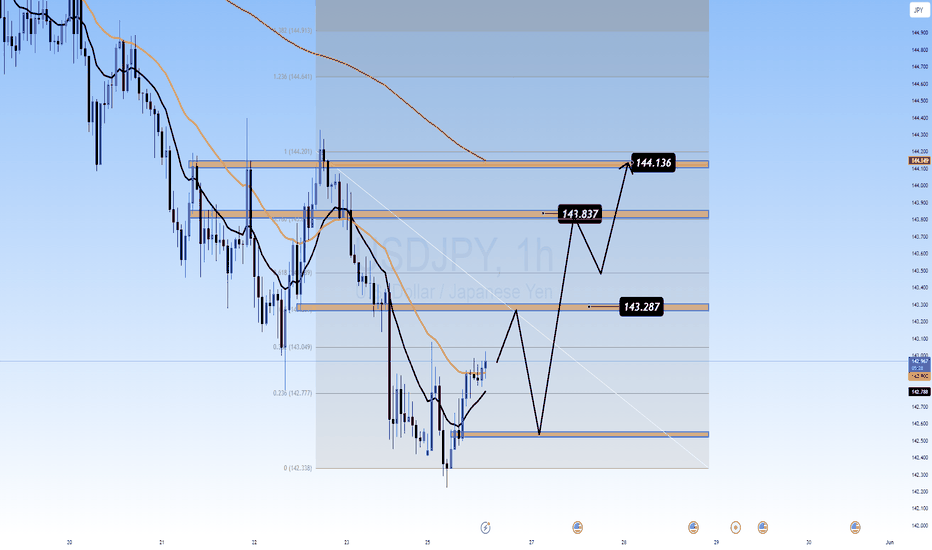

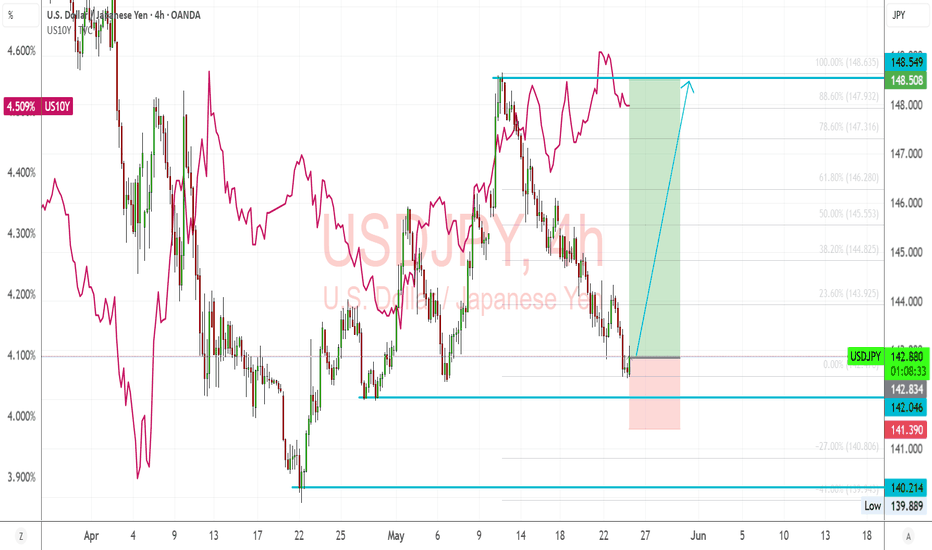

USDJPY

– Diverging Policies Drive Yen into Pressure

Zone near 14USDJPY

– Diverging Policies Drive Yen into

Pressure Zone near 144

🌍 Macro Landscape: JPY Stuck

Between Two Diverging Forces

In recent weeks, the US dollar has

regained strength as the Federal

Reserve remains committed to its

"higher-for-longer" interest rate

stance. On the flip side, the Bank

of Jap

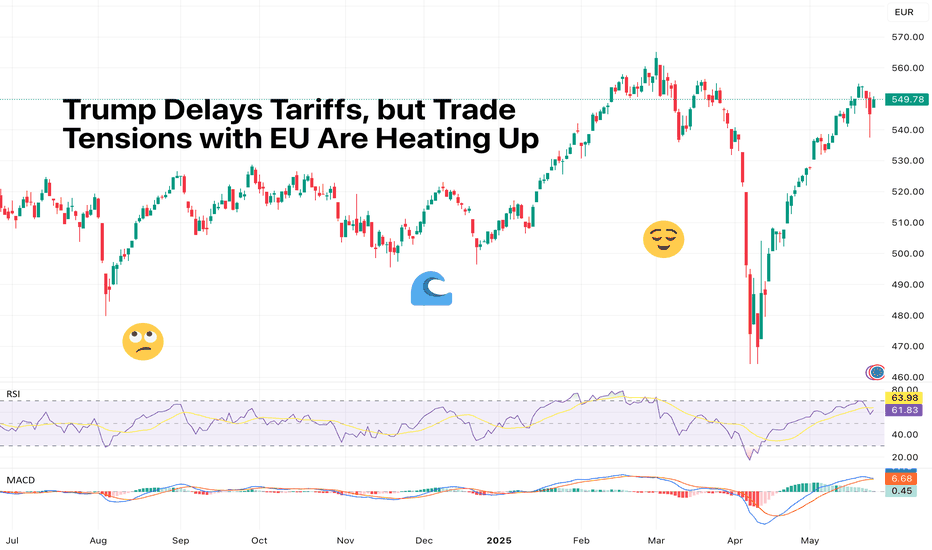

Trump

Delays Tariffs, but Trade Tensions with EU

Are Heating UpDonald

Trump is back in headline mode — and

this time, the EU is in his

crosshairs.

After weeks of relative calm, the US

President reignited global trade

tensions by announcing a 50% tariff

on all EU imports. But in a surprise

twist — and in true reality-TV

fashion — he’s now pushed the start

date

SMR

NNE OKLO – Breakout Setup Triggered by

Nuclear CatalystNYSE:SMR

is lighting up after Trump’s

announcement on nuclear energy — and

it’s not alone. NYSE:OKLO and

NASDAQ:NNE are also setting up, but

NYSE:SMR has one of the cleanest

breakout structures on the board.

🔹 Catalyst: Trump’s nuclear energy

announcement yesterday is putting

serious momentu

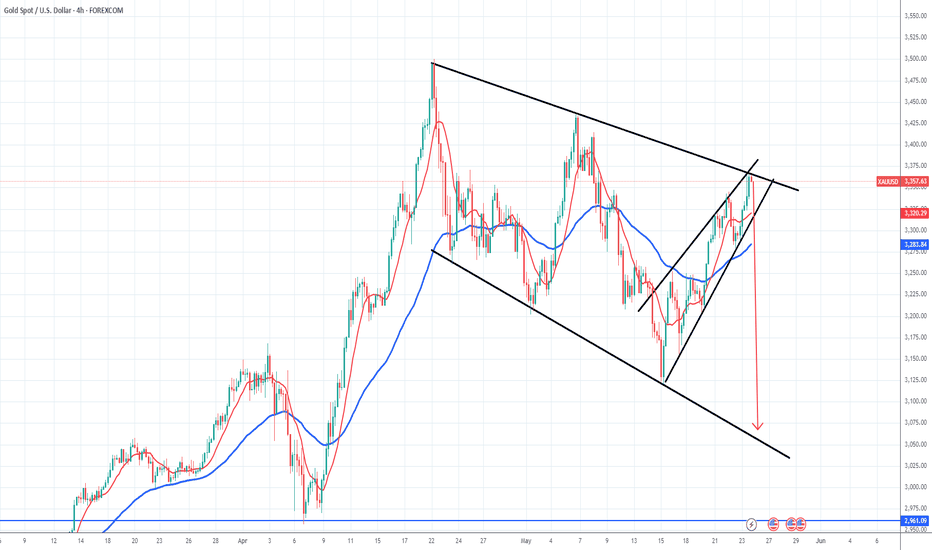

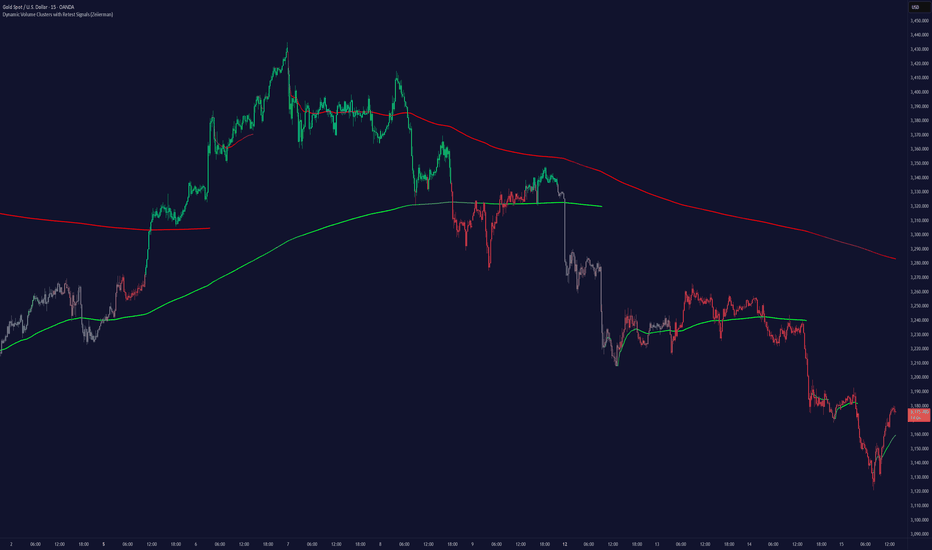

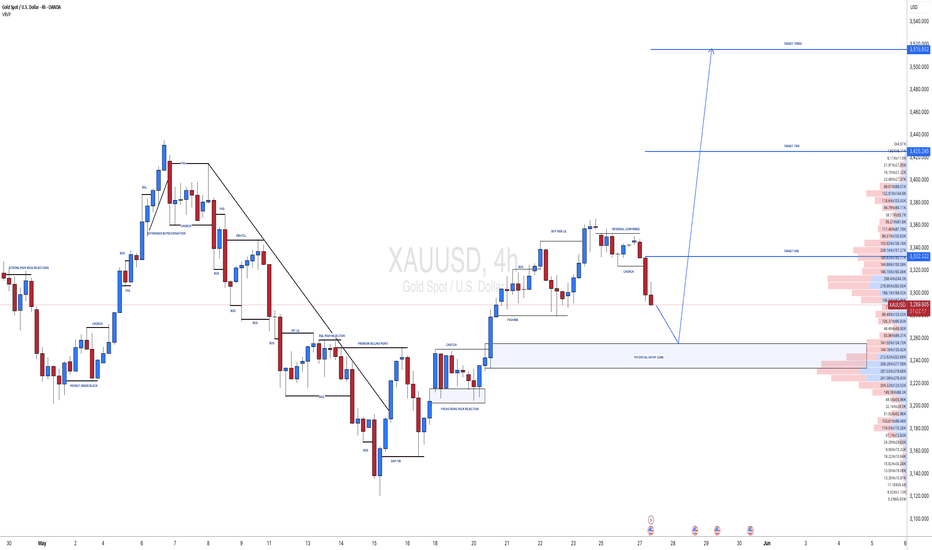

GOLD

Price Analysis: Key Insights for Next Week

Trading DecisionGold

prices surged last week, ending with

a strong 3.9% weekly gain, closing

around the $3,365 zone after

bouncing back with conviction on

Friday. In this video, I break down

why gold rallied, what key events

influenced price action, and how I’m

reading the current chart structure

to strategically p

Gold

at a Crossroads: Key Resistance Levels in

FocusFrom

the Trading Desk of InvestmentLive:

Gold has struggled to sustain any

meaningful downward momentum,

despite our broader bearish bias on

the yellow metal. After a sharp

decline the week before, last week

saw gold stage an even stronger

recovery, pushing higher and

regaining lost ground.

Howeve

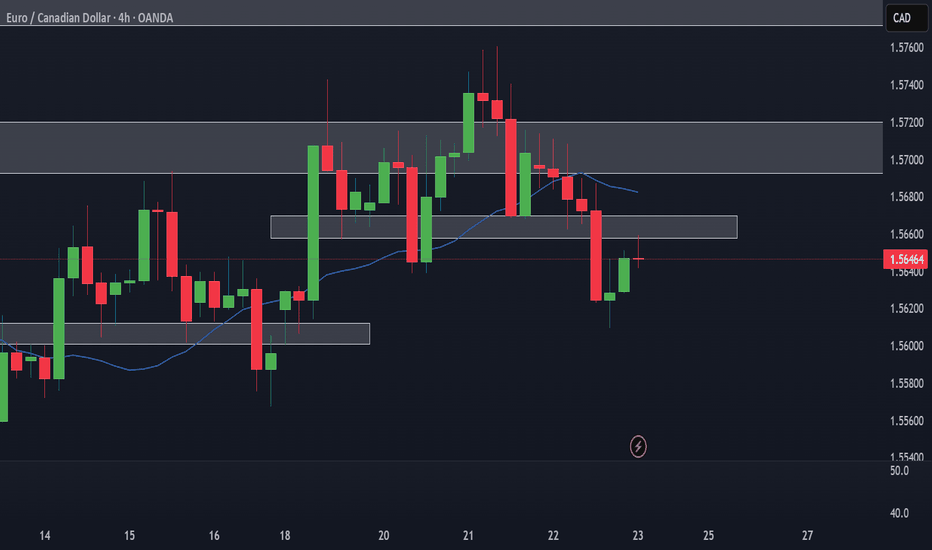

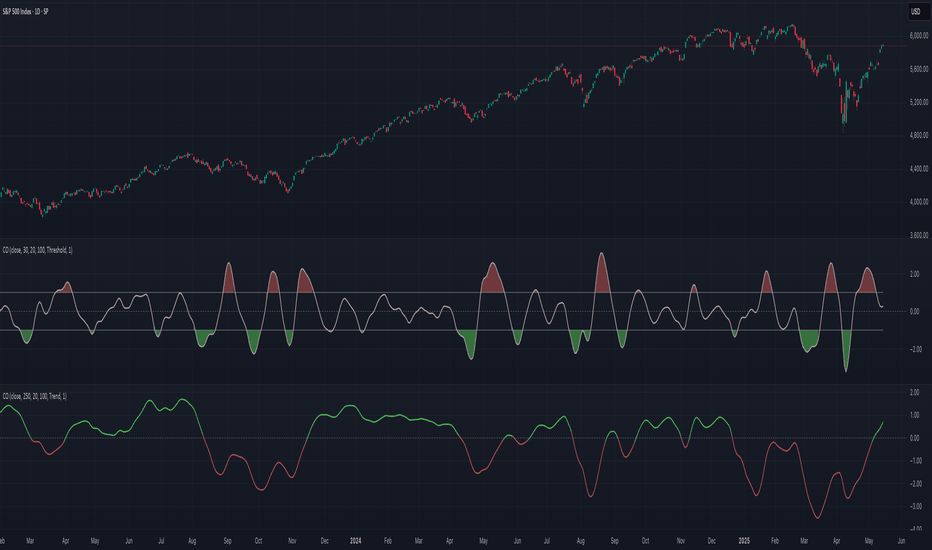

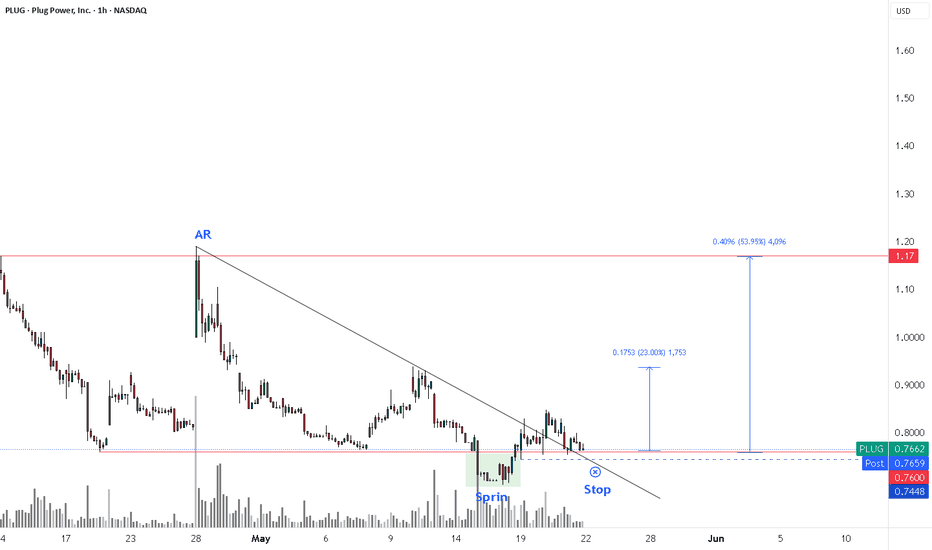

Use

a Top Down Approach to gather as much

CONFLUENCE as possibleAll

the information you need to find a

high probability trade are in front

of you on the charts so build your

trading decisions on 'the facts' of

the chart NOT what you think or what

you want to happen or even what you

heard will happen. If you have

enough facts telling you to trade in

a certain dir

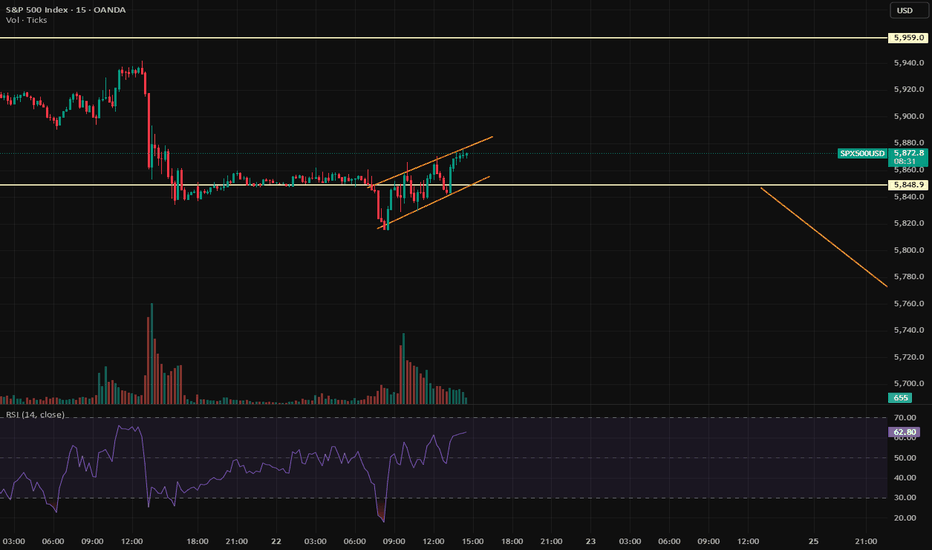

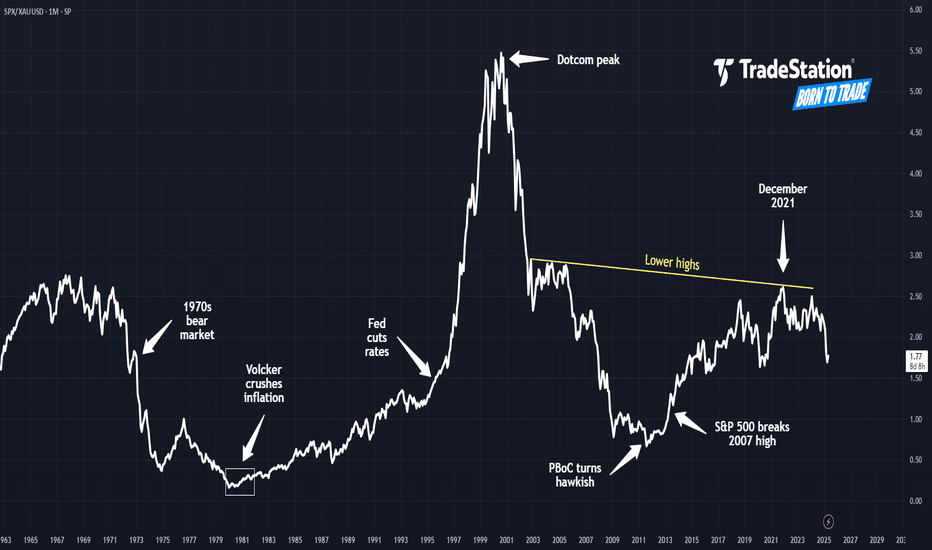

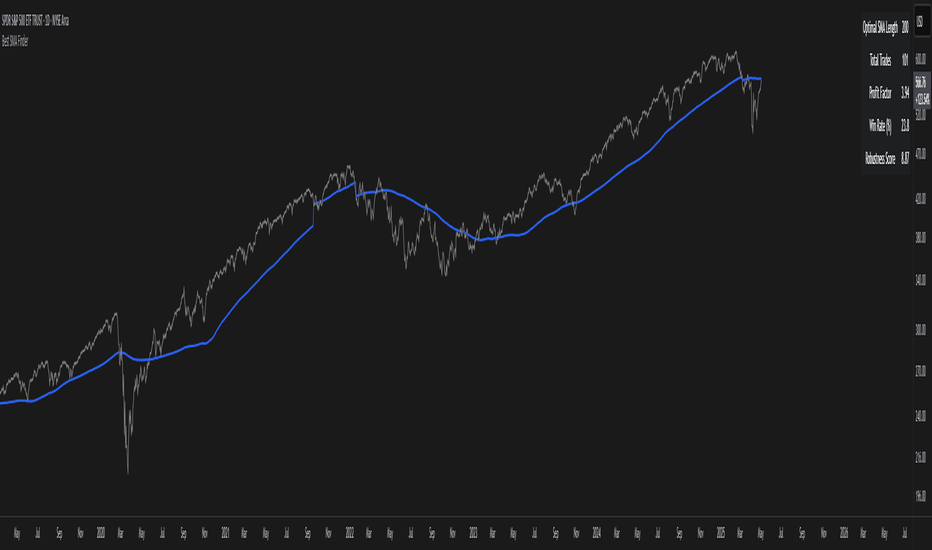

Stocks

Have Been in a Bear Market for 25 Years, By

This MeasureThe

S&P 500 hit a new all-time high

in February. However, by one measure

it’s been in a bear market all

century.

Today’s monthly chart shows SP:SPX

as a ratio against gold. Using this

comparison, equities have

underperformed since Bill Clinton

was still President in August 2000.

It illustrates h

See all editors' picks ideas

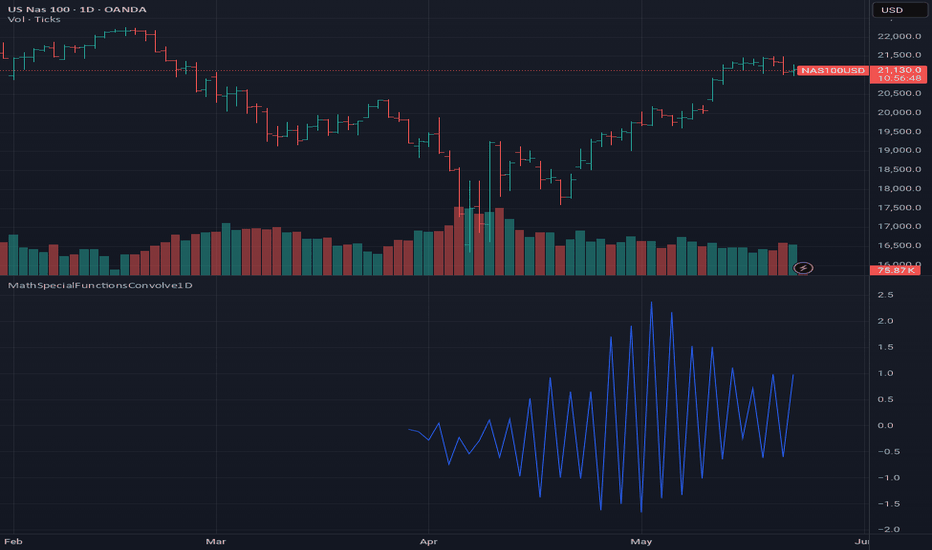

MathSpecialFunctionsConvolve1DLibrary

"MathSpecialFunctionsConvolve1D"

Convolution is one of the most

important mathematical operations

used in signal processing. This

simple mathematical operation pops

up in many scientific and industrial

applications, from its use in a

billion-layer large CNN to simple

image denoising.

___

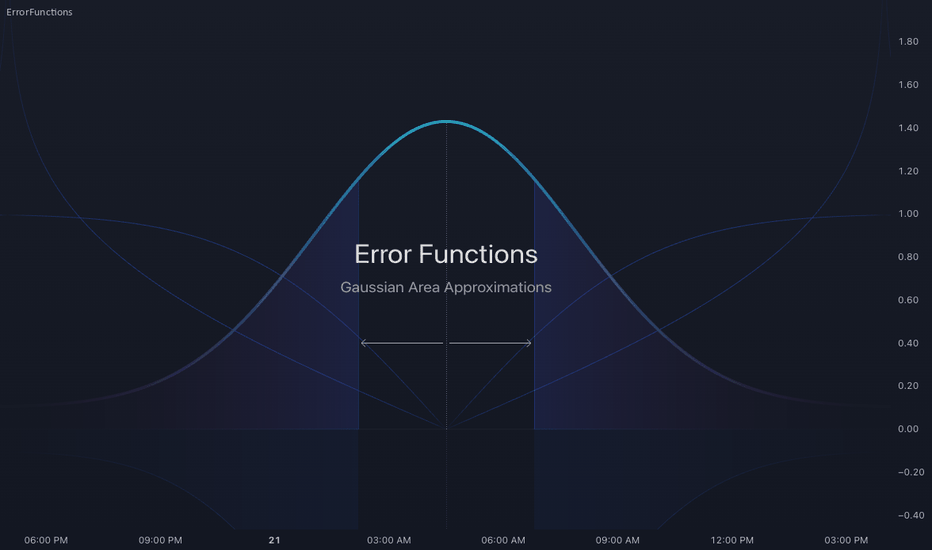

ErrorFunctionsLibrary

"ErrorFunctions"

A collection of functions used to

approximate the area beneath a

Gaussian curve.

Because an ERF (Error Function) is

an integral, there is no closed-form

solution to calculating the area

beneath the curve. Meaning all ERFs

are approximations; precisely wrong,

but mostly a

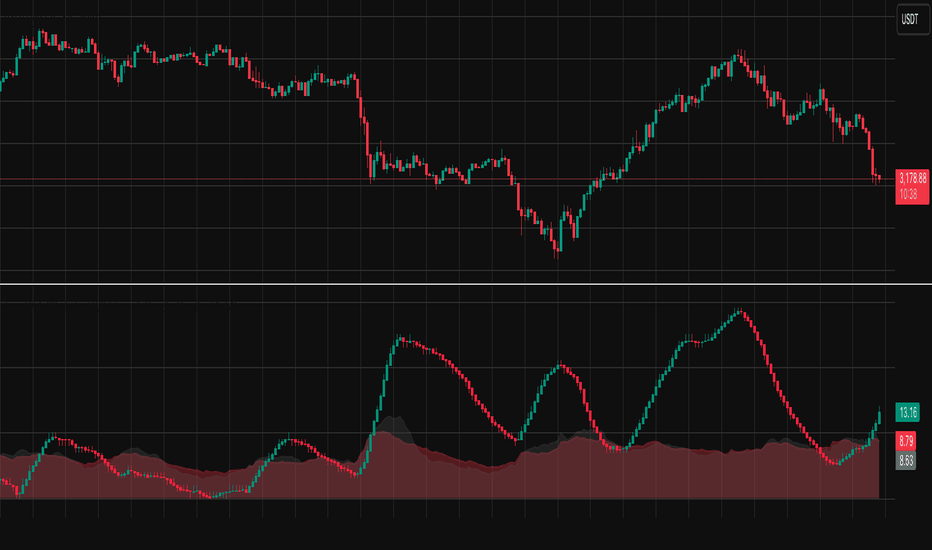

Trend

Volatility Index (TVI)Trend

Volatility Index (TVI)

A robust nonparametric oscillator

for structural trend volatility

detection

⸻

What is this?

TVI is a volatility oscillator

designed to measure the strength and

emergence of price trends using

nonparametric statistics.

It calculates a U-statistic based on

the Gini mea

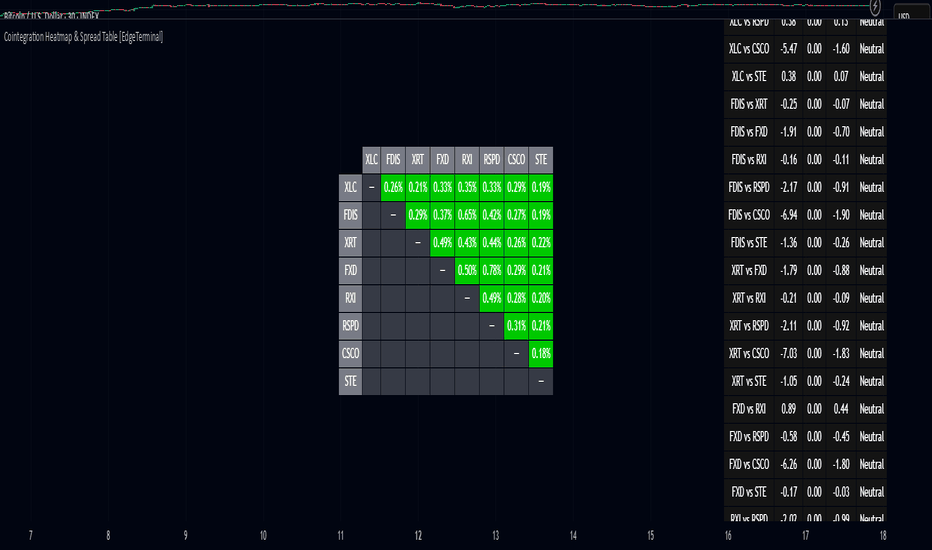

Cointegration

Heatmap & Spread Table

[EdgeTerminal]The

Cointegration Heatmap is a powerful

visual and quantitative tool

designed to uncover deep,

statistically meaningful

relationships between assets.

Unlike traditional indicators that

react to price movement, this tool

analyzes the underlying statistical

relationship between two time series

and

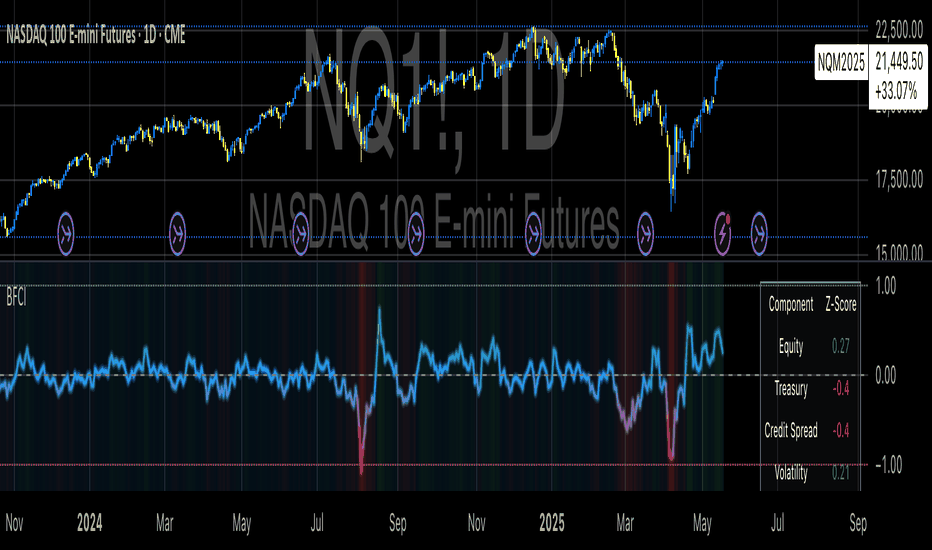

Bloomberg

Financial Conditions Index (Proxy)The

Bloomberg Financial Conditions Index

(BFCI): A Proxy Implementation

Financial conditions indices (FCIs)

have become essential tools for

economists, policymakers, and market

participants seeking to quantify and

monitor the overall state of

financial markets. Among these

measures, the Bloomberg

TASC

2025.06 Cybernetic Oscillator█

OVERVIEW

This script implements the

Cybernetic Oscillator introduced by

John F. Ehlers in his article "The

Cybernetic Oscillator For More

Flexibility, Making A Better

Oscillator" from the June 2025

edition of the TASC Traders' Tips .

It cascades two-pole highpass and

lowpass filters, then

sca

Dynamic

Volume Clusters with Retest Signals

(Zeiierman)█

Overview

The Dynamic Volume Clusters with

Retest Signals indicator is designed

to detect key Volume Clusters and

provide Retest Signals. This tool is

specifically engineered for traders

looking to capitalize on

volume-based trends, reversals, and

key price retest points.

The indicator

seamles

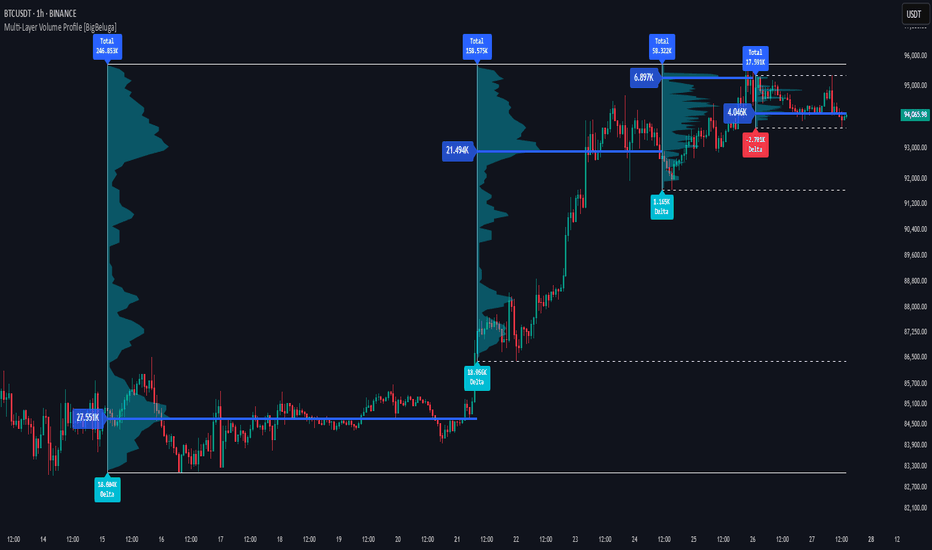

Multi-Layer

Volume Profile [BigBeluga]A

powerful multi-resolution volume

analysis tool that stacks multiple

profiles of historical trading

activity to reveal true market

structure.

This indicator breaks down total and

delta volume distribution across

time at four adjustable depths —

enabling traders to spot major POCs,

volume shelves,

pymath█

OVERVIEW

This library ➕ enhances Pine

Script's built-in types (`float`,

`int`, `array`, `array`) with

mathematical methods, mirroring 🪞

many functions from Python's `math`

module. Import this library to

overload or add to built-in

capabilities, enabling calls like

`myFloat.sin()` or

`myIntArra

Best

SMA FinderThis

script, Best SMA Finder, is a tool

designed to identify the most robust

simple moving average (SMA) length

for a given chart, based on

historical backtest performance. It

evaluates hundreds of SMA values

(from 10 to 1000) and selects the

one that provides the best balance

between

profitability,

See all indicators and strategies

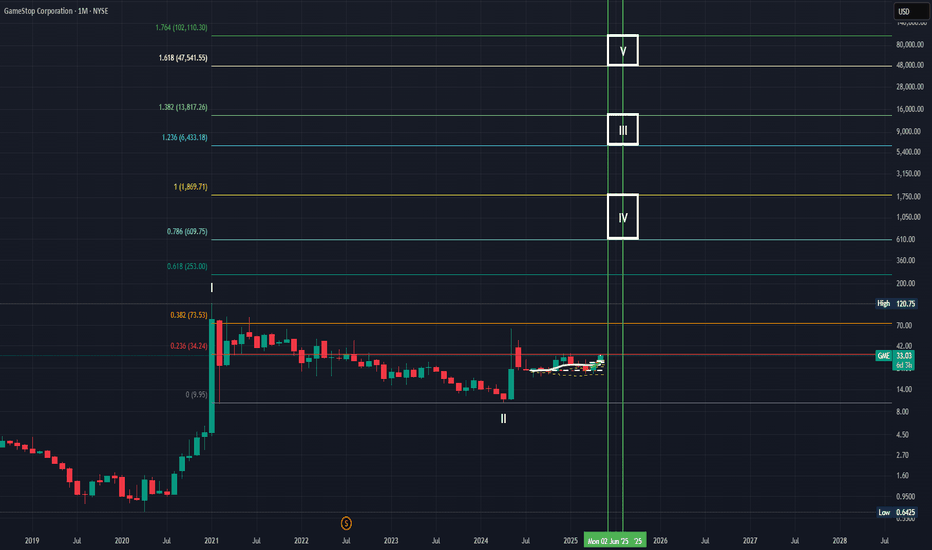

GME:

GameStop Stock Zig-Zags on First Bitcoin

Purchase — 4,710 Coins Worth $500 Million

SPX:

S&P 500 Rebounds with 2% Gain as Markets

Cheer Trump’s Tariff Delay on Europe Goods

XAU/USD:

Gold Rebounds to Reclaim $3,300 as Traders

Weigh Softening Trade Tensions

Japan Bonds

Draw Weak Demand as Rise in Superlong Yields

Sparks Concern — Update

Canada PM

Carney Says Ottawa, Washington in Intensive

Talks on New Economic, Security Deal — 3rd

Update

AAPL: Apple

Stock Jumps as Traders Anticipate Tariff

Reprieve for iPhone Maker

GBP/USD:

Sterling Breaks Out to Fresh 3-Year Top Near

$1.36. How High Is Too High?

IXIC:

Nasdaq Futures Rally as Tech Lovers Cheer

Trump’s Tariff Timeout on EU. Now What?

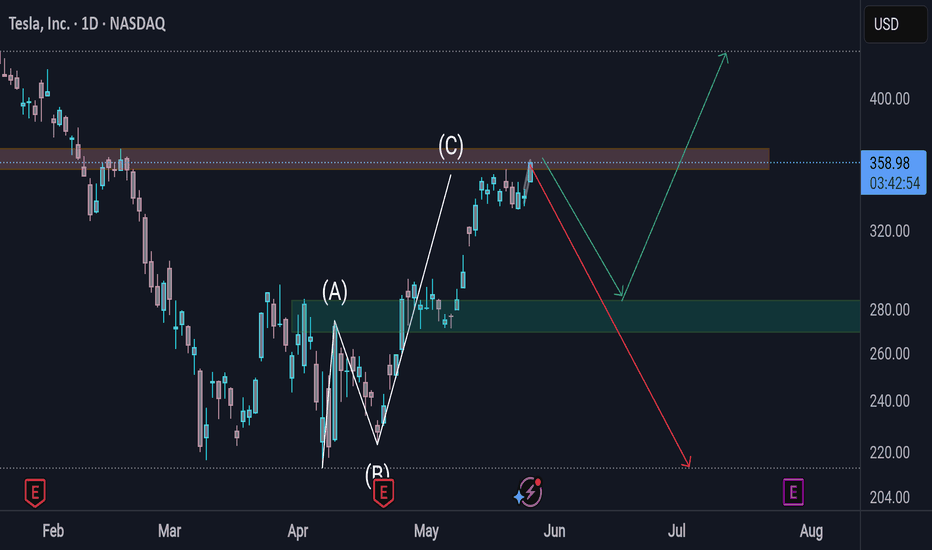

Tesla's

European Sales Halved in April Despite EV

Market Growth

EUR/USD:

Euro Swings to One-Month High Above $1.14 on

Trump’s Tariff Backpedalling

BTC/USD:

Bitcoin Stabilizes Near $110,000 as Traders

Take Wait-and-See Approach on Next Run

SXXP: STOXX

600 Pops 1% in Relief Rally After Trump

Extends Tariff Deadline to July 9

Trump

Threatens EU With 50% Tariffs, Takes Aim at

Apple; Dow Drops — WSJ

Trump

Threatens EU With 50% Tariffs, Takes Aim at

Apple; Dow Opens Lower — WSJ

Trump

Threatens EU With 50% Tariffs, Takes Aim at

Apple; Dow Futures Sink — WSJ

NVDA:

Nvidia Stock in the Red for the Year Ahead

of Big Earnings Update. Here’s What to

Expect.

GBP/USD:

Sterling Hits Fresh 3-Year High at $1.3480

as UK Retail Sales Surprise to Upside

RL: Ralph

Lauren Stock Rises 1.2% as Revenue Soars to

$1.7 Billion. Price Hikes Ahead.

U.K. Retail

Sales Rise for Fourth-Straight Month,

Boosted by Warm Weather

IXIC:

Nasdaq Composite Stands as Only Winner as

Stocks Tumble in Final Moments of Trading

BTC/USD:

Bitcoin Goes Nuclear Above $111,000 —

Where’s It Going Next?

USD/JPY:

Yen on Track for 8th Gain in a Row After

Japan’s Bond Yields Hit All-Time High

DJI: Dow

Jones Wipes Out 800 Points as Treasury

Auction Fails to Excite Investors

Community trends

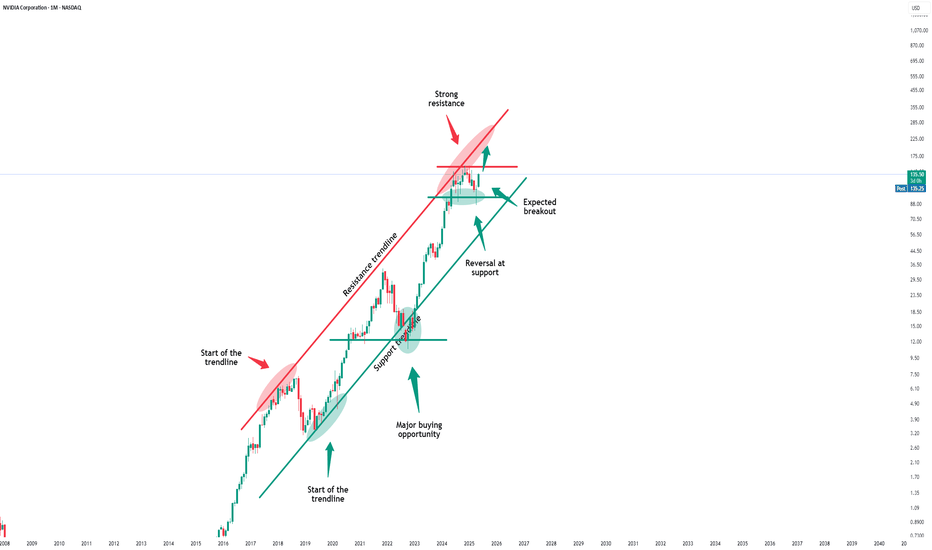

Nvidia

- The breakout will

eventually follow!Nvidia

- NASDAQ:NVDA - will

break out soon:

(click chart above

to see the in depth

analysis👆🏻)

Over the course of

the past couple of

days, we saw a quite

strong rally of +50%

on Nvidia.

Considering the

market cap of this

company, such a move

is quite impressive.

Following this

overall very

str

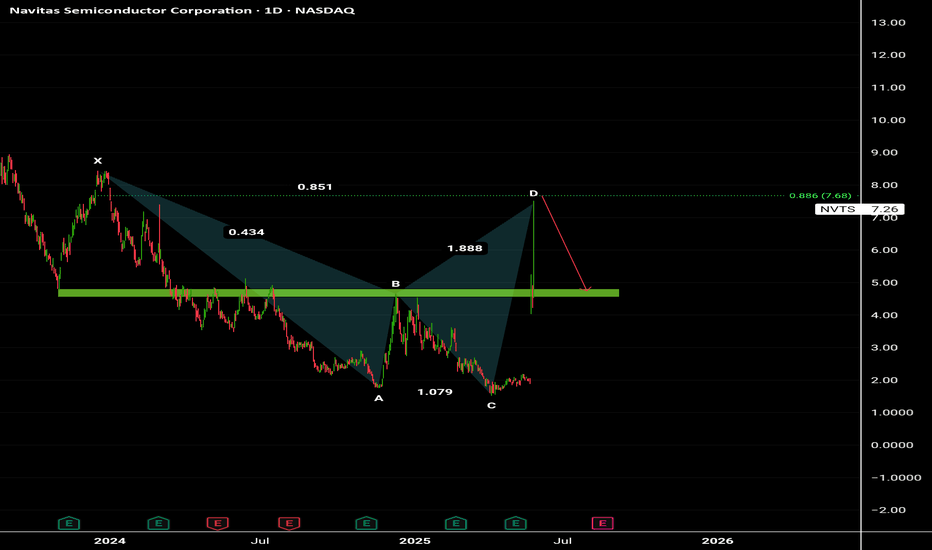

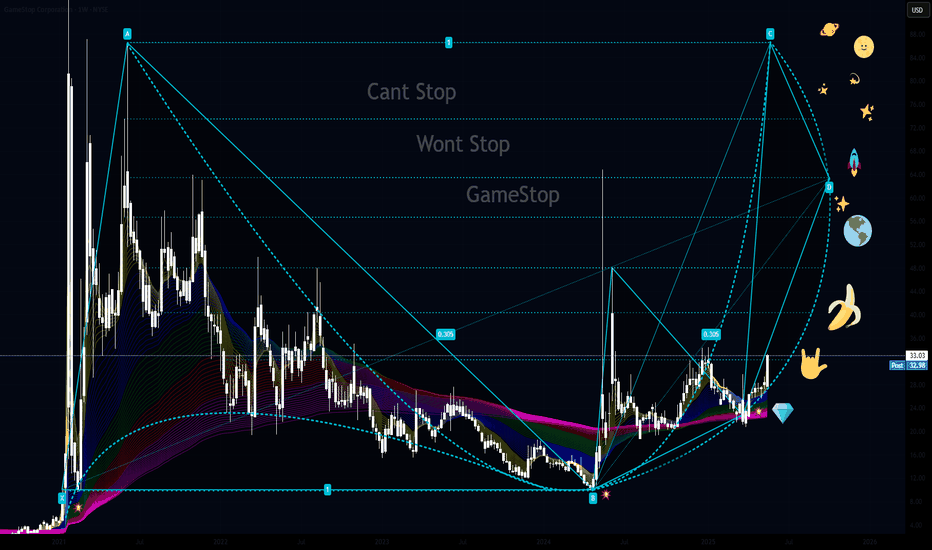

WC:

33.03 Target: 1800-2400

MOASS: 47k-100K: TICK

TOCKIt

would be easy to be

really hyperbolic

with my tone and

words right based on

the latest price

action...but I'm NOT

going to be

I am a TRADER and in

order to extract

profit consistently

over time its

important to manage

the PSYCHOLOGICAL

aspect of trading

well i.e. your

emotions

That's why I

goin

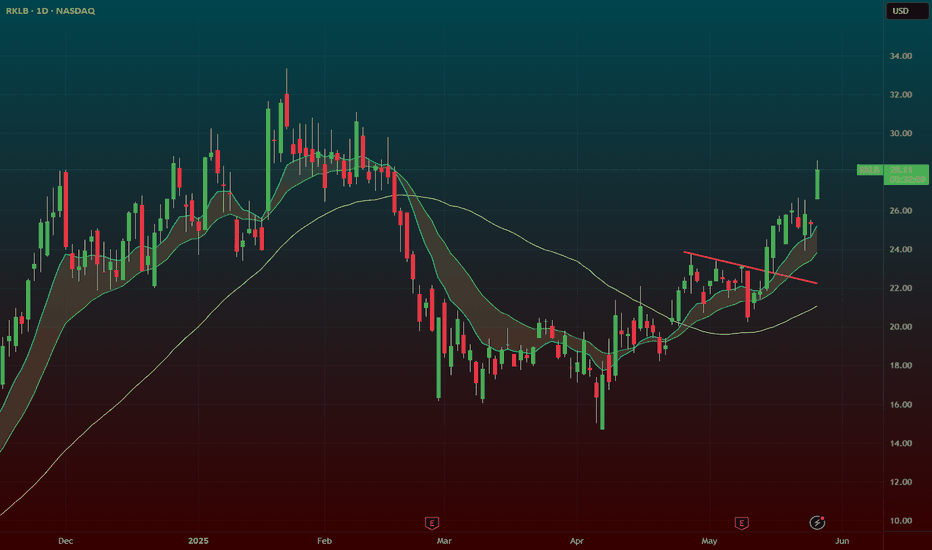

Update

on Nuclear Stocks SMR, OKL0

+ NEW IDEAS VRT, TSLA OKLO,

SMR going through

the roof. NNE is

trailing today. Sold

out most of the

RKLB.

Lets go over the

SPY, QQQ which are

flagging now after

holding support.

Liking this VRT and

LTBR AND LUNR for

potential swings

along with HIMS!

Lets dig into the

charts and see whats

up!

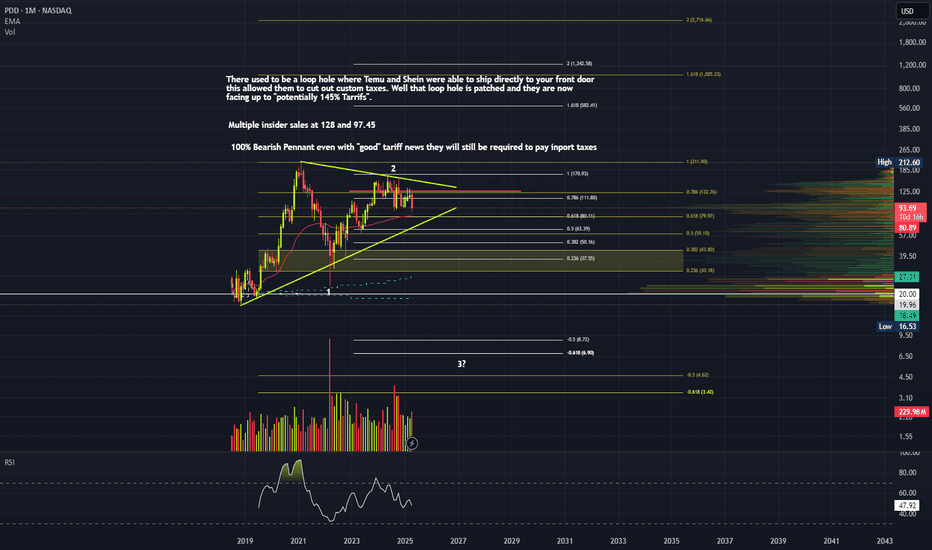

$PDD

Set To flip bearishSignificant

downside risk based

on a combination of

fundamental,

macroeconomic, and

geopolitical

factors. One major

reason for this

pessimistic outlook

could be valuation

concerns; the

current stock price

may appear

overvalued relative

to key metrics like

earnings, revenue

growth, or free cash

flow.

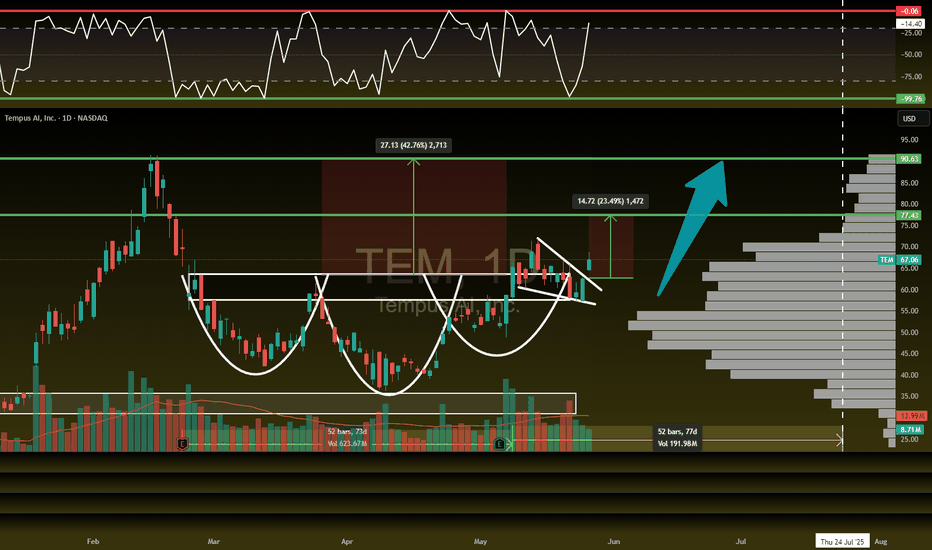

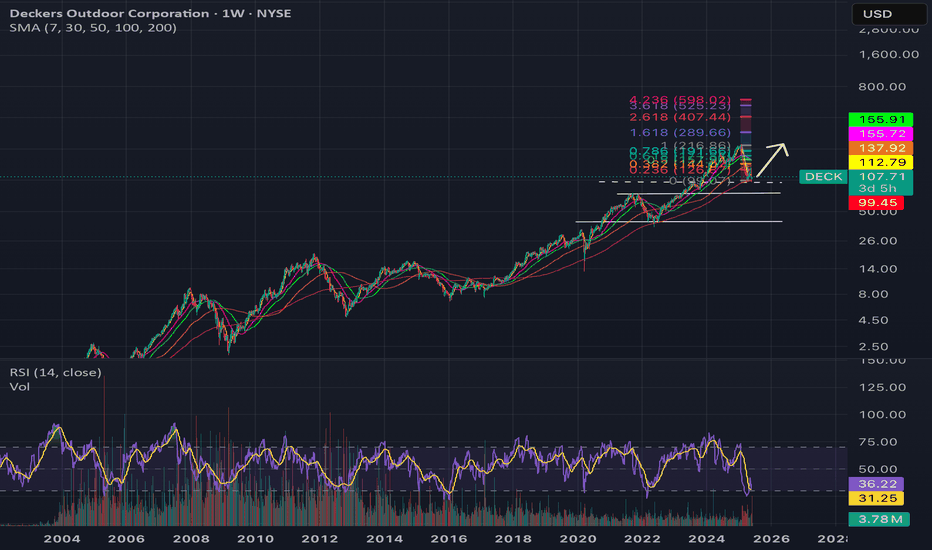

Long

$DECK -

NYSE:DECK is the

only growth story

I'm comfortable

buying. This was

wall street darling

for many years. I

believe sell off was

overdone.

- It has lot of room

to run. It is

getting traction and

NYSE:NKE because of

law of large number

is not growing much

in %age.

- However, NYSE:DECK

has

l

See all stocks ideas

Today

ITRNIturan

Location and Control Ltd.

Actual

0.73

USD

Estimate

0.69

USD

Today

CMCOColumbus

McKinnon Corporation

Actual

0.60

USD

Estimate

0.57

USD

Today

CPRICapri

Holdings Limited

Actual

−4.90

USD

Estimate

−0.13

USD

Today

MMacy's

Inc

Actual

0.16

USD

Estimate

0.15

USD

Today

DKSDick's

Sporting Goods Inc

Actual

3.37

USD

Estimate

3.37

USD

Today

CLGNCollPlant

Biotechnologies Ltd.

Actual

0.13

USD

Estimate

−0.04

USD

Today

SOTKSono-Tek

Corporation

Actual

0.02

USD

Estimate

0.02

USD

Today

RSVRReservoir

Media, Inc..

Actual

0.04

USD

Estimate

0.04

USD

See more events

Pretzelmaker Cranks Up the Heat

with Cheetos® Flamin’ Hot®

Pretzel Bites

ROTH Announces the Addition of

Kyle Bauser, Ph.D. to its

Healthcare Research Team

Sign in to read exclusive news

Sign in to read exclusive news

Sign in to read exclusive news

Sign in to read exclusive news

Sign in to read exclusive news

Sign in to read exclusive news

Sign in to read exclusive news

Sign in to read exclusive news

Sign in to read exclusive news

Sign in to read exclusive news

Sign in to read exclusive news

Sign in to read exclusive news

Sign in to read exclusive news

Sign in to read exclusive news

Sign in to read exclusive news

Sign in to read exclusive news

Sign in to read exclusive news

Benevis Celebrates Decade-Long

Impact of Delivering Free Dental

Care to Over 3,800 Uninsured

Children and Adults During

Sharing Smiles Day

Sign in to read exclusive news

Sign in to read exclusive news

Sign in to read exclusive news

EVAI Surpasses Major Emissions

Milestones With Over 620,000 EV

Miles Traveled and Nearly $275K

in Fuel Savings Achieved

FedEx and ShopRunner Voluntarily

Comply with BBB National

Programs’ Digital Privacy

Watchdog Consumer Data Privacy

Standards

Community trends

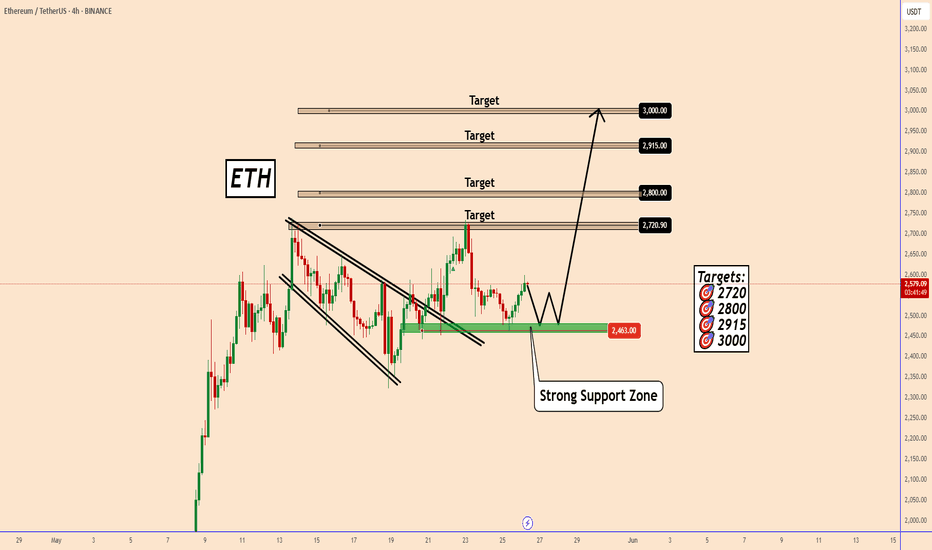

ETH:

Still optimistic and in transformationETH:

Still optimistic and in

transformation

Previously, ETH showed a strong

bullish trend, but recent economic

events have shaken things up.

On Friday, U.S. President Donald

Trump announced a 50% tariff on the

European Union, set to begin on June

1, 2025. This caused uncertainty in

financial mark

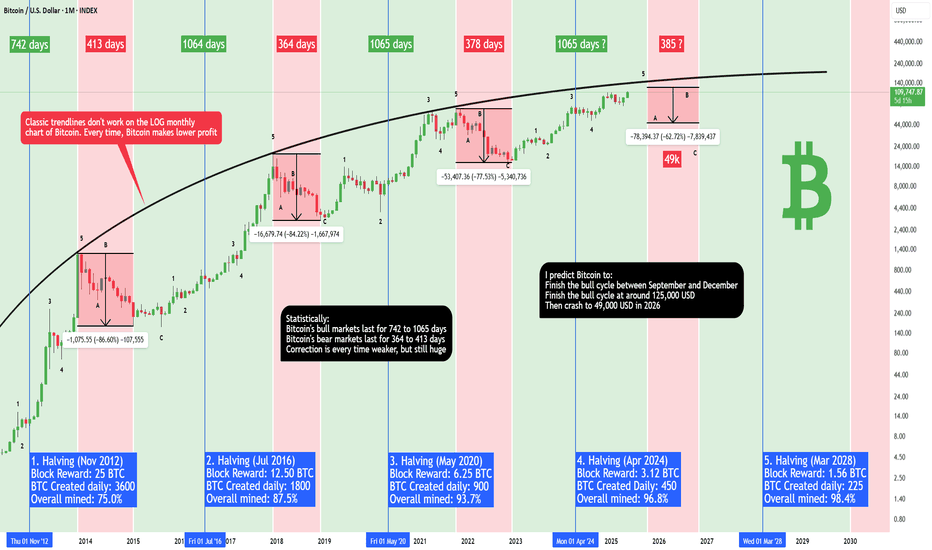

Bitcoin

- Hardcore pump 125k and dump 49k (must

see!)In

this very detailed and unique

analysis, we will look at the most

important Bitcoin fundamental

analysis of halving cycles. I

predict Bitcoin will crash to 49k in

2026, so if you are buying now for

the long term as an investment (buy

and hold), you can probably wait for

a better price! We can

stat

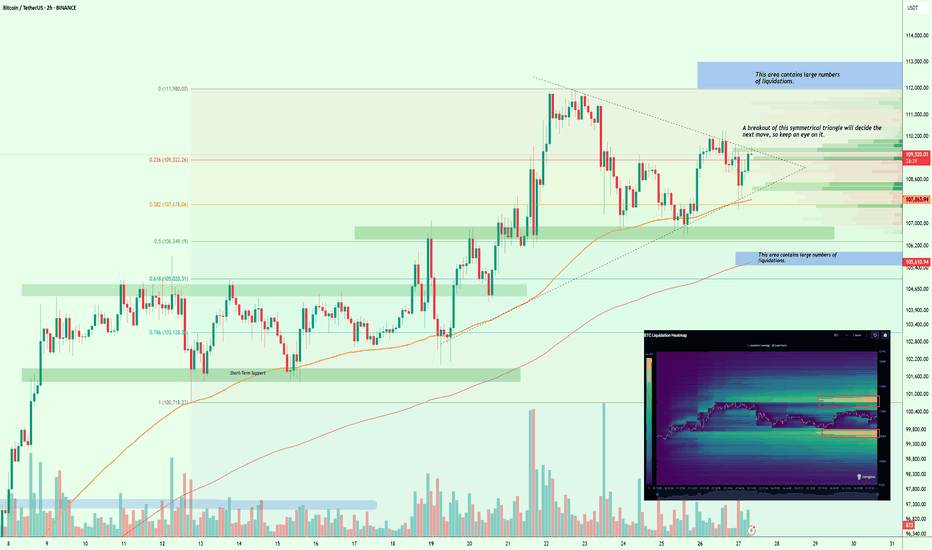

$BTC

Liquidity Squeeze Incoming – Breakout or

Breakdown?#Bitcoin

According to the liquidation heat

map, CRYPTOCAP:BTC is building a

large cluster of liquidations on

both the upside and downside,

creating some confusion in the

market. However, the nearest major

liquidation zone is around

$112K–$113K, which increases the

chances of a move toward that

ra

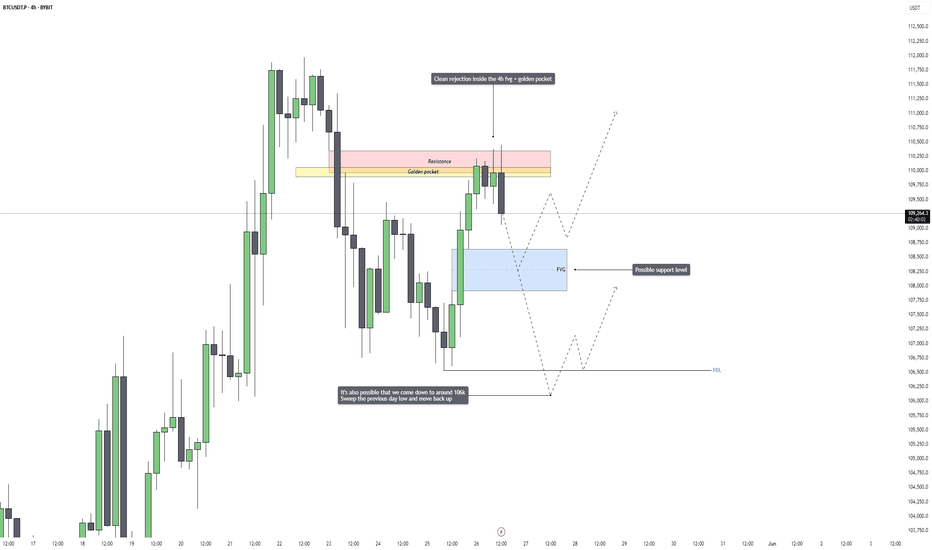

Bitcoin

– Possible 4h Sweep at 106.5kBitcoin

recently printed a sharp rejection

after revisiting a key supply area

formed by a 4H fair value gap,

overlapping perfectly with the

golden pocket zone from the most

recent down move. This confluence

provided a strong technical ceiling,

causing a clear reaction and

shifting short-term

sentime

Is

Bitcoin Ready for Its Next Leg Up? Here’s

What We Know So FarBitcoin

BITSTAMP:BTCUSD is so back — not

just back like “we recovered the

dip,” but back like “new all-time

highs, let’s go shopping for Lambos

on moons” back.

If you’ve been following our Top

Stories coverage, you’ll know that

the OG token vaulted past $109,500

last week, then kissed

$11

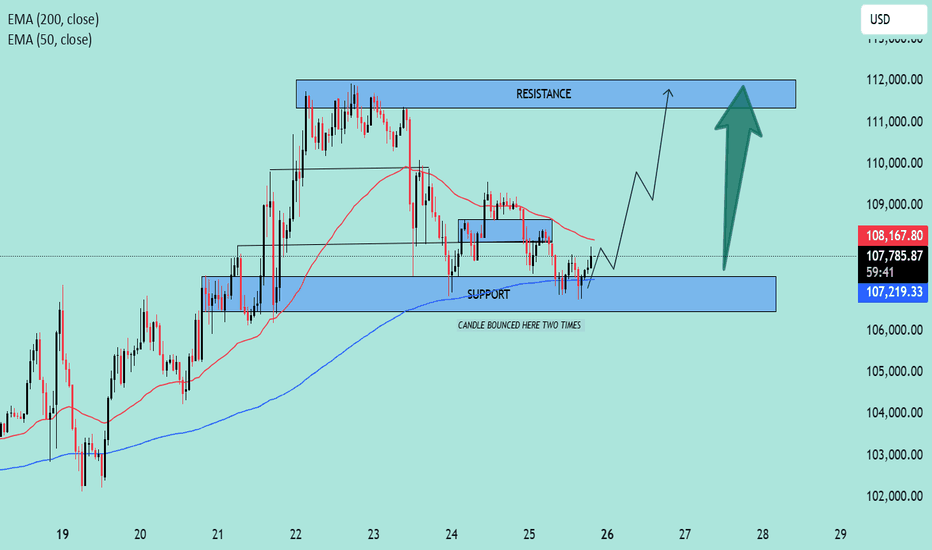

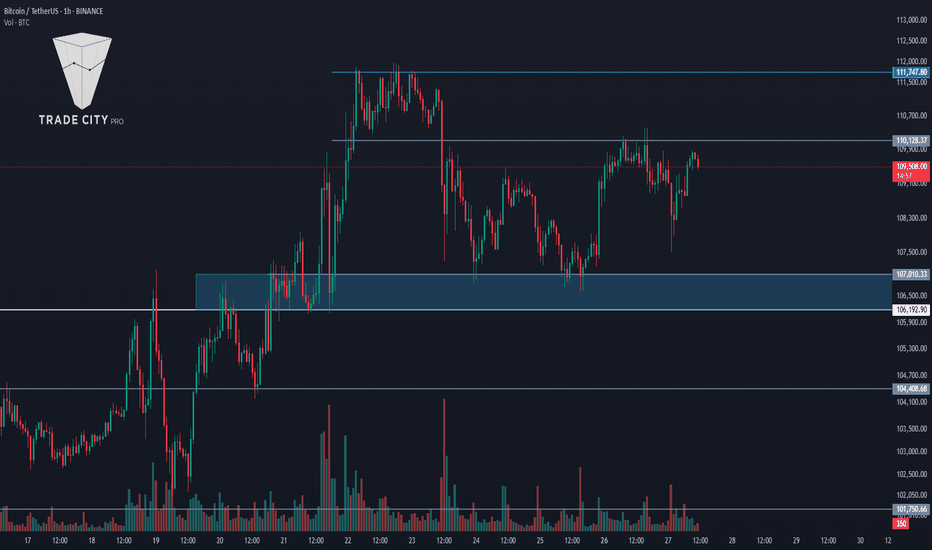

BTC/USD

Rebound in Play! | Key Support Holding, Eyes

on $112K📊

BTC/USD Technical Analysis

🗓️ Chart Date: May 25, 2025

🔍 Key Levels:

🔵 Support Zone: $106,800 – $107,300

Notably, price bounced twice in this

region, indicating strong buying

interest.

This area aligns closely with the

200 EMA (currently at $107,213.51),

adding further confluence as dynamic

sup

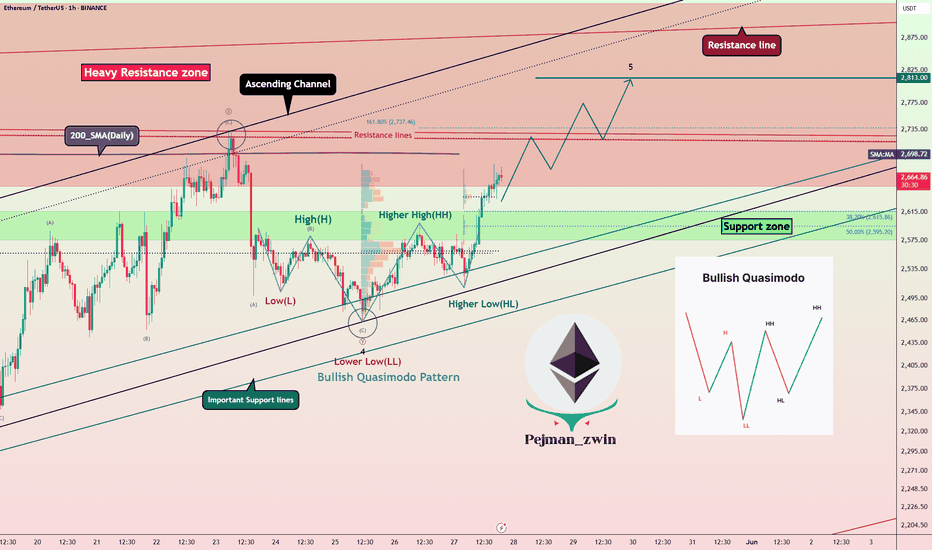

Quasimodo

Pattern + Validator Support = Bullish Signal

for ETHToday

I want to analyze Ethereum (

BINANCE:ETHUSDT ) for you, many

tokens are on the Ethereum network ,

and the increase or decrease of

Ethereum directly affects most

tokens.

So please stay with me.

Ethereum is trading in a Heavy

Resistance zone($2,929_$2,652) near

the Resistance

line

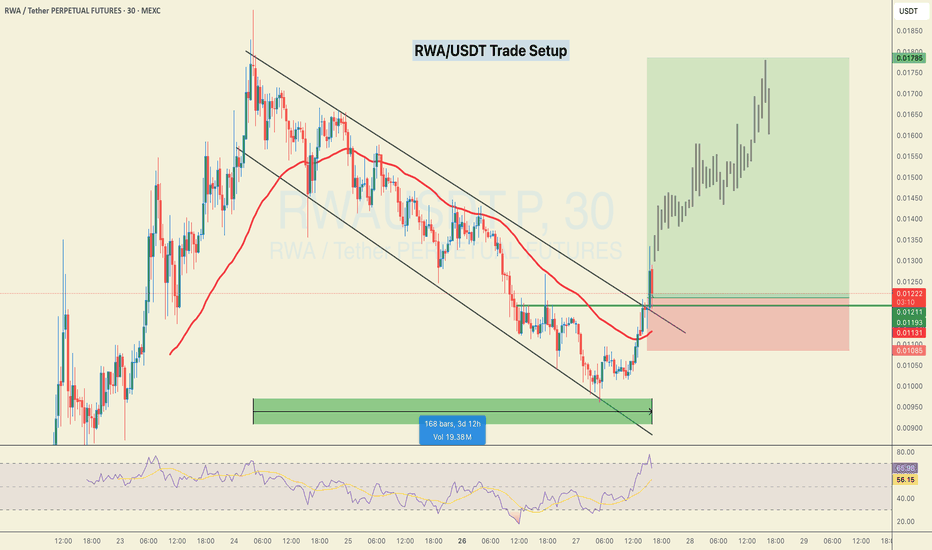

$RWA

is ready for a massive 50% pump.About

RWA:- Allo is building the world’s

first exchange for tokenised stocks

with 24/7 trading, low fees and

instant settlement to democratize

investing. Built on blockchain

technology, Allo has tokenised $2.2B

in RWAs, staked $50M in BTC, and

launched a $100M lending facility.

The fundamentals

loo

TradeCityPro

| Bitcoin Daily Analysis #103👋

Welcome to TradeCity Pro!

Let’s dive into Bitcoin and key

crypto indices. As usual, in this

analysis I’ll walk you through the

triggers for the New York futures

session.

⏳ 1-Hour Timeframe

As you can see on the 1-hour chart,

Bitcoin was rejected from the 110128

resistance yesterday and began a

pu

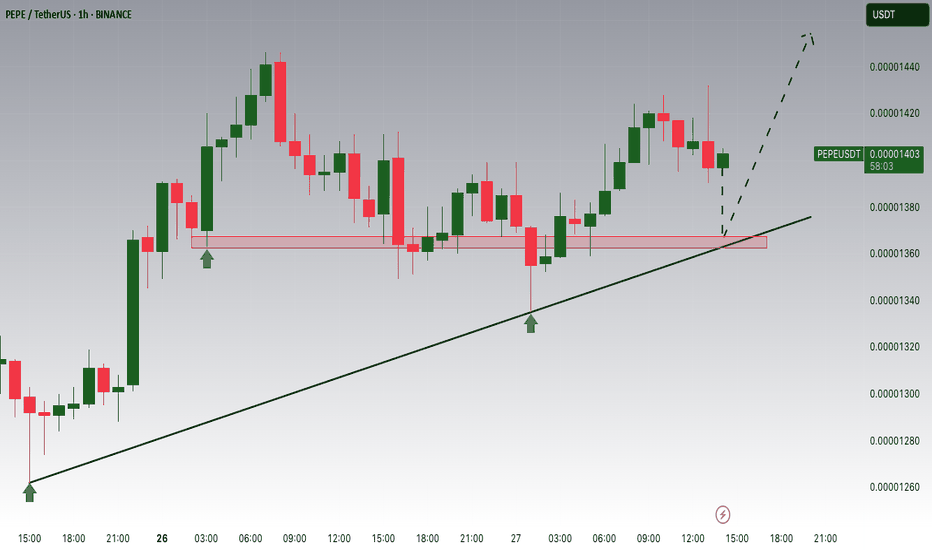

PEPE/USDT

Potential UpsidesHey

Traders, in today's trading session

we are monitoring PEPE/USDT for a

buying opportunity around 0.00001360

zone, PEPE/USDT is trading in an

uptrend and currently is in a

correction phase in which it is

approaching the trend at 0.00001360

support and resistance area.

Trade safe, Joe.

See all crypto ideas

Here’s what

happened in crypto today

Sign in to

read exclusive news

New FCA Crypto

Custody Rules Would Force Firms to Upgrade

Security

Cork Protocol

pauses contract amid $12 million DeFi exploit

Bitcoin price

will reach $130K or even $1.5M, top bulls say

UK FCA requests

public comments on stablecoin, crypto custody

regulation

MIND of Pepe

Presale 3 Days Away from Ending – Last Chance to

Buy the Best AI Agent Coin

SEC Begins

Review of First Spot XRP ETF Bid with WisdomTree

Proposal

NFT monthly

sales break 2025 downward trend in May:

CryptoSlam

Sign in to

read exclusive news

SUI price chart

hints at 2x rally amid Nasdaq ETF filing

Elon Musk’s xAI

inks $300M deal with Telegram for Grok

integration

Ethereum DeFi

protocol Euler to launch EulerSwap DEX with

lending-boosted yield

Bitcoin Hits

New Heights: Analyst Predicts Next Peak By Late

2025

Former

Chainlink, Two Sigma execs build ‘Moirai’ to

uncover crypto gems

Bitcoin Could

Explode On Bessent’s $250 Billion Deregulation

Shock

GameStop buys

bitcoin worth $513 million in crypto push

XRP price set

for 48% jump as spot ETF reality draws closer

GameStop

officially confirms first Bitcoin purchase of

4,710 BTC

Trump’s crypto

czar David Sacks outlines pathway to expand US

Strategic Bitcoin Reserve

GameStop buys

4,710 bitcoin for corporate treasury: filing

Trump Media’s

Stock Drops Despite $2.5 Billion Bitcoin

Treasury Announcement

Blockasset

(BLOCK) - Buybacks on DEFINITIVE - 28 May 2025

KuCoin (KCS) -

DN.com - From 23 May to 12 Aug 2025

Solidus Ai Tech

(AITECH) - Inferium Public Sale - 28 May 2025

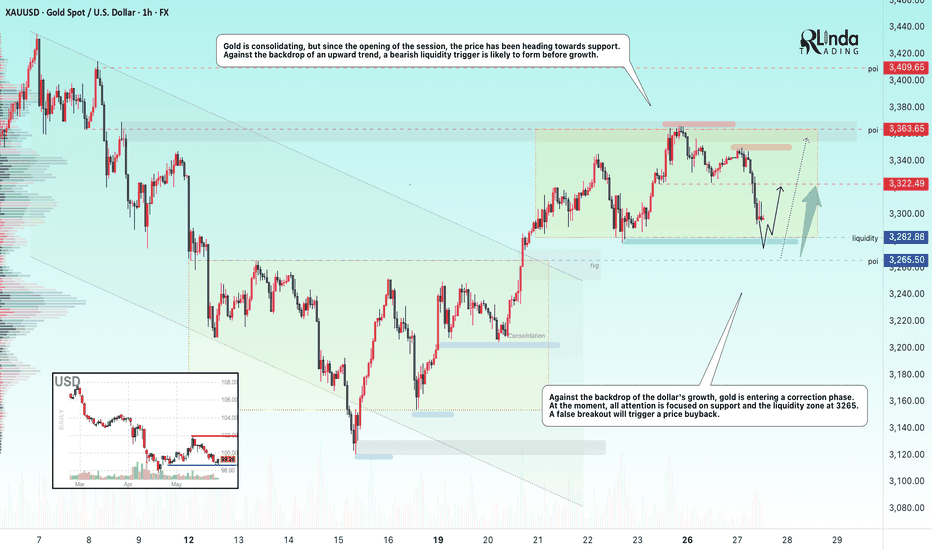

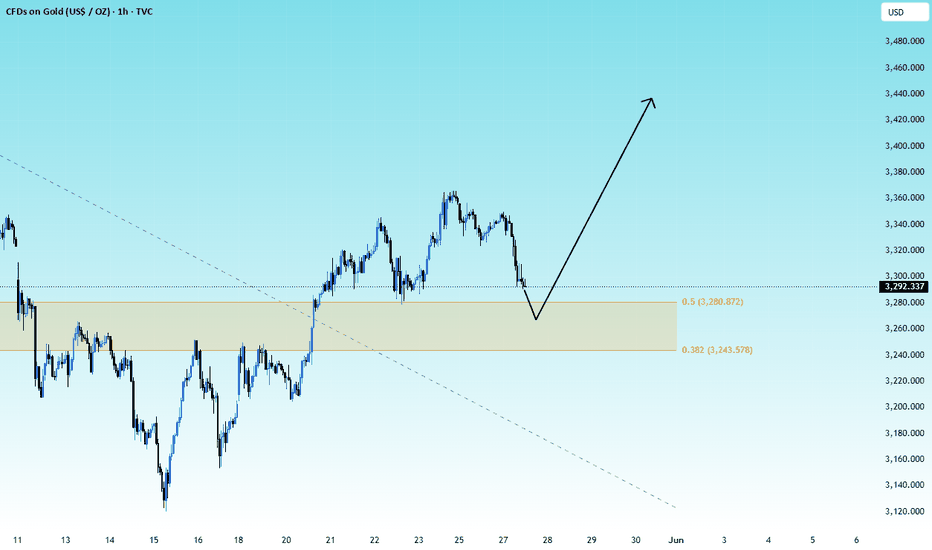

GOLD

→ Correction before possible growthFX:XAUUSD

entered a liquidation phase (rally)

within the trading range at the

opening of the session. The dollar's

rise is to blame. The focus is on

supporting consolidation...

Investors remain interested in gold

as a safe haven asset amid

geopolitical risks and declining

demand for US

assets.

Gold

Fibonacci Analysis of (XAU/USD)📊

Fibonacci Levels Overview:

23.6% Level: Minor correction zone,

price rejected this area and

continued lower.

38.2% Level: Acted briefly as a

support but eventually broken.

50.0% Level (~$2,351.6): Currently

being tested — a key level. Price is

consolidating here.

61.8% Level: If 50% breaks

deci

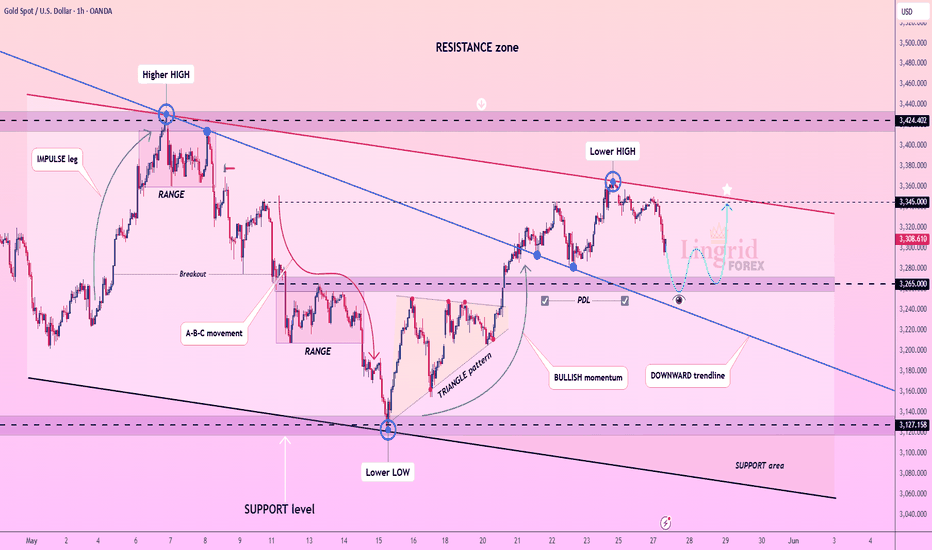

Lingrid

| GOLD Key SUPPORT Zone Bounce

OpportunityOANDA:XAUUSD

is consolidating after a rejection

from the descending resistance

trendline near 3345, with price now

approaching the prior demand zone

around 3265. If this support holds,

a bullish reaction could propel

price back toward the 3345–3350 zone

for another retest. The broader

pattern refl

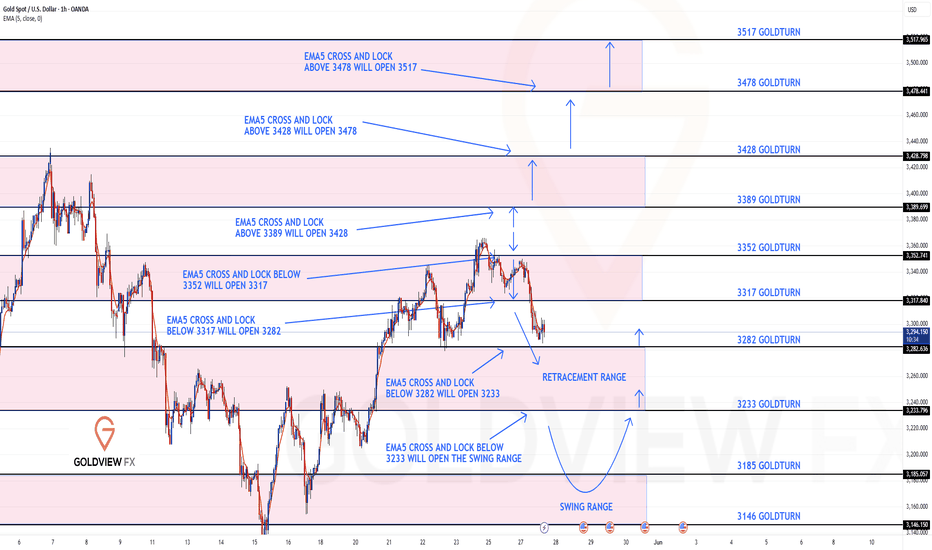

GOLD

1H CHART ROUTE MAP UPDATEHey

Everyone,

Please see update on our 1H chart

route map, playing out as analysed.

We started the week with a bearish

gap at 3352 being hit, followed by

ema5 cross and lock below 3352,

which opened up the next level at

3317, also hit perfectly. We are now

seeing ema5 cross and lock below

3317, op

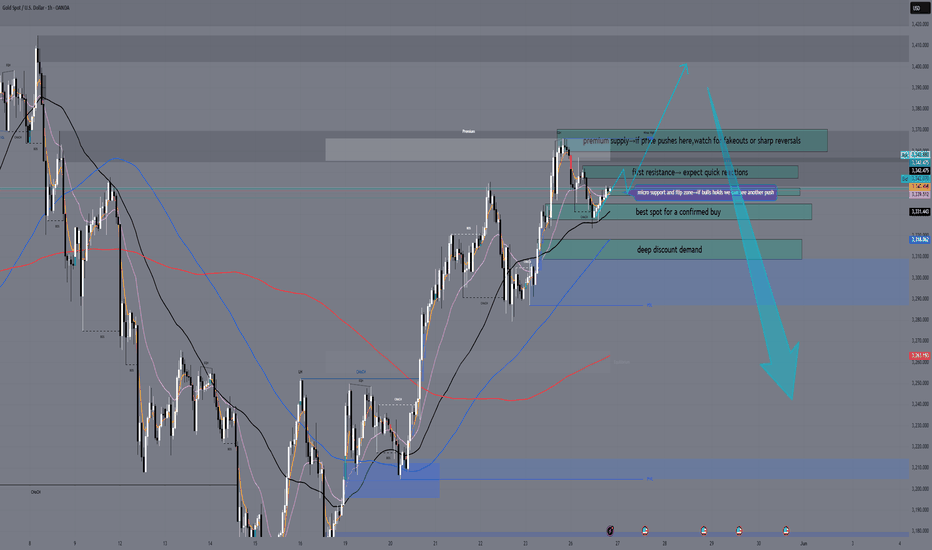

Gold

Daily Plan – 27 May 2025 | Sniper Eyes

OnlyHey

GoldMinds! Hope you’re ready – price

action is about to get spicy. We’re

coming off a slow Monday, but

Tuesday’s bringing a real

battlefield between bulls and bears.

Here’s what you need to watch like a

hawk:

Key Structure Zones to Watch

ABOVE PRICE

3,347 – 3,353:

First real resistance —

expect

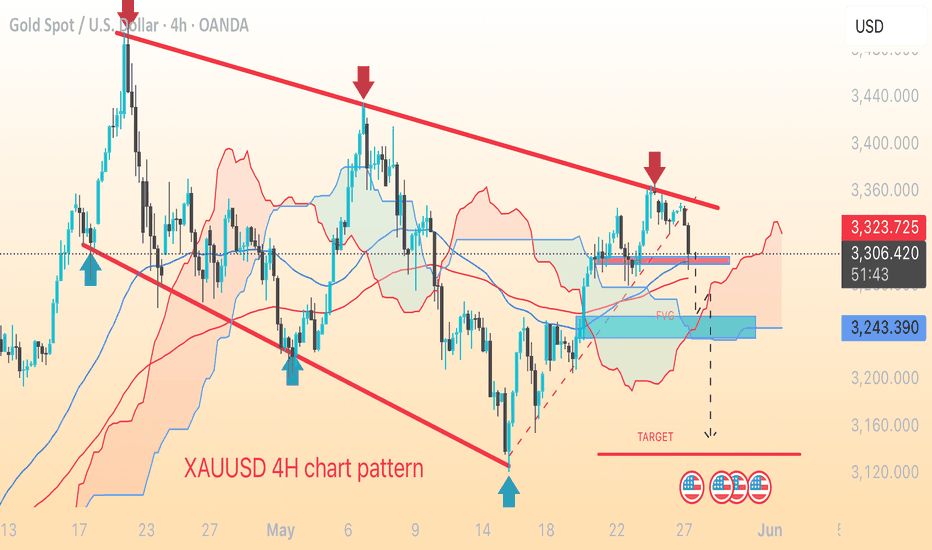

XAUUSD..

gold 4H charts pattern I'm

outlining a short (SELL) trade setup

for XAU/USD (Gold). Here's a

breakdown of your trade idea:

Entry: 3308 (SELL)

First Target (FVG): 3250

(FVG likely refers to a Fair Value

Gap – a liquidity target in

imbalanced price zones)

Final Target: 3140

Let’s assess the setup:

Key Points to

Consid

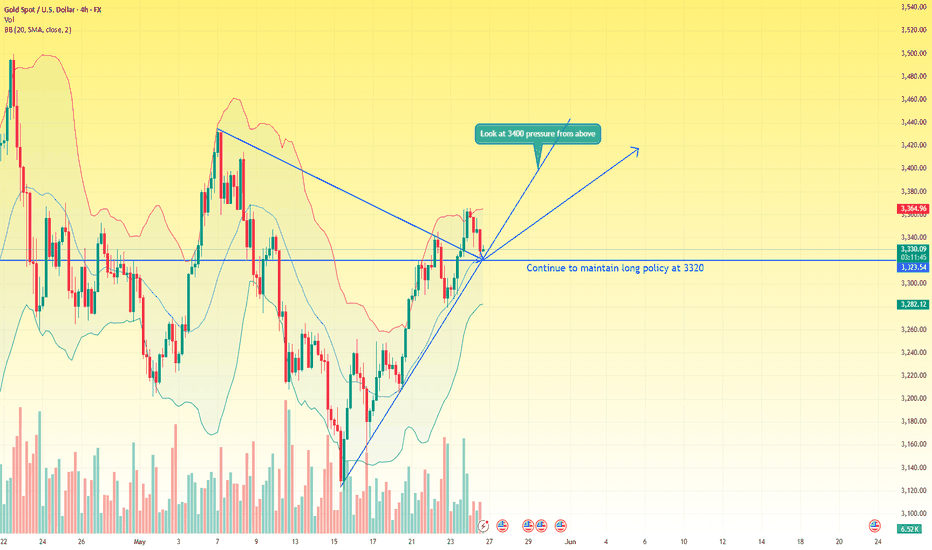

Gold

long funds are pouring in like crazy!According

to the current four-hour trend

analysis, the focus below is on the

3330-3320 range support, and the

focus above is on the 3380-3400

resistance. In terms of overall

strategy, maintain a long position

before breaking 3320 to avoid

blindly guessing the top. Gold

recommendation: Buy when it

fa

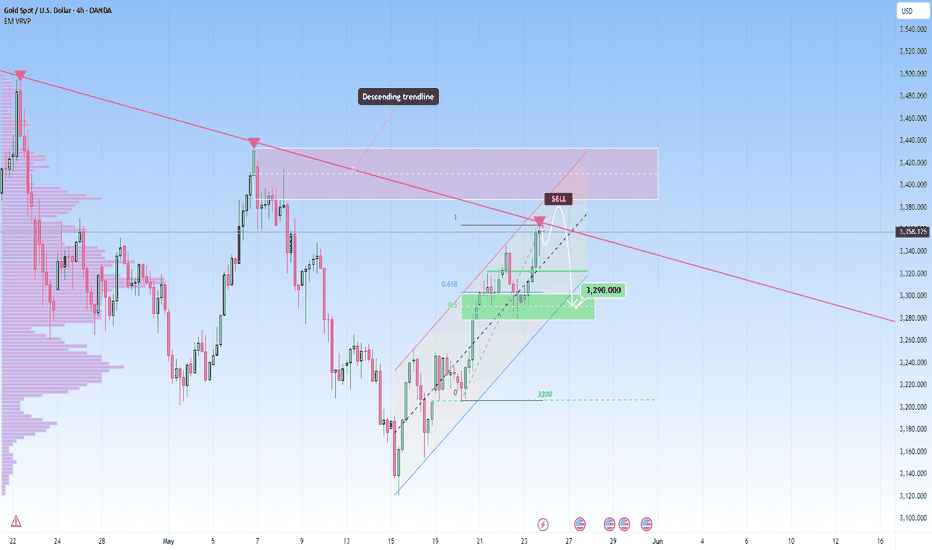

GOLD

increased in the short term: Break down

expectedThe

Gold market has been very strong for

some time, but I don’t think this

will continue to be the case going

forward. As we’ve seen, the price

has rallied a bit on Friday with

Trump’s EU tariff threats.

Market structure starts to hint

exhaustion, as such overbought

conditions often lead to

generou

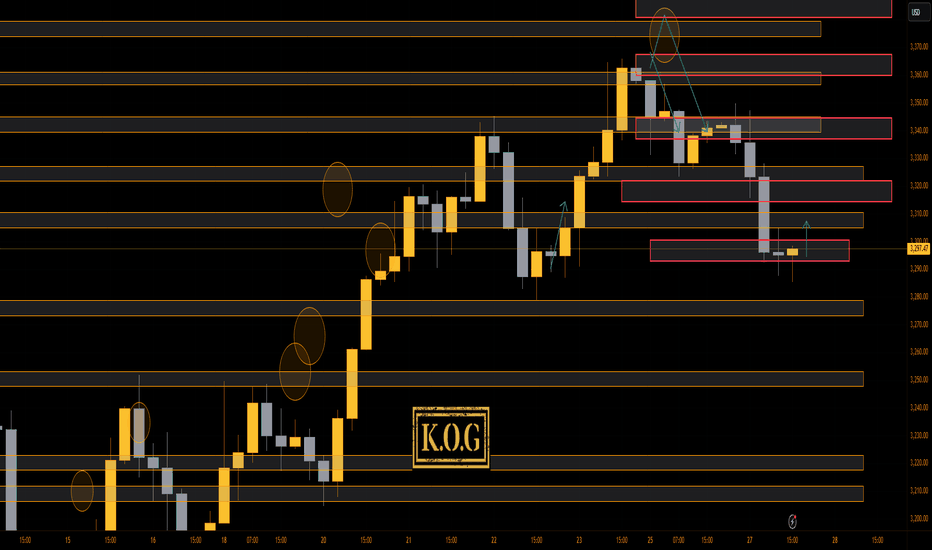

THE

KOG REPORT - UpdateEnd

of day update from us here at KOG:

It's been a fantastic start to the

week with the red box holding nicely

to give traders the short trade

using the red boxes and KOG's target

levels, which are all completed for

the week here.

We now have support below at the

3285 level which if continues to

h

XAUUSD:[GOLD]:

First Drop And Then Reverse! Comment Your

Views! Gold

touched $3350 but was rejected at

that level, dropping around 3288.

The price shows some minor support

at this region, which we’re

currently monitoring. If it breaks

through, it could touch our buying

zone, reversing the trend. You can

set three targets based on your own

analysis and bias.

Plea

See all futures ideas

Cotton Futures

Drift Lower

US natgas

prices climb 2% to 2-week high on lower output,

higher demand forecasts

Baltic Dry

Index Up Slightly

Sign in to

read exclusive news

Sign in to

read exclusive news

Sign in to

read exclusive news

Sign in to

read exclusive news

Sign in to

read exclusive news

Sign in to

read exclusive news

BCM Resources

Corporation Completes Non-Brokered Financing

West High Yield

(W.H.Y.) Resources Ltd. Fully Endorses Draft

Minister's Designation Report on the Record

Ridge Critical Minerals Project

Robusta coffee

hits 5-1/2 month low, cocoa extends fall

Sign in to

read exclusive news

Cash markets

strengthen amid some prompt supply disruptions

Lithium Sinks

to Over 4-Year Low

West Red Lake

Gold Delineates High-Grade Lenses of Gold

Adjacent to Current Development

Gold Steadies

Ahead Fed Minutes

Soybean Futures

at Over 1-Week Low

Tereos warns of

difficult year ahead on low EU sugar prices

Elemental Altus

Notes Continued Growth at Royalty Assets with

A$250m Laverton Acquisition and Hercules Maiden

Reserve

Golden Rapture

Mining Identifies Strong Linear Anomalies

throughout the Project Area from Airborne

Magnetic Survey

Sign in to

read exclusive news

OPEC+ may

discuss 2027 baselines and agree July hike this

week, sources say

Sign in to

read exclusive news

Sign in to

read exclusive news

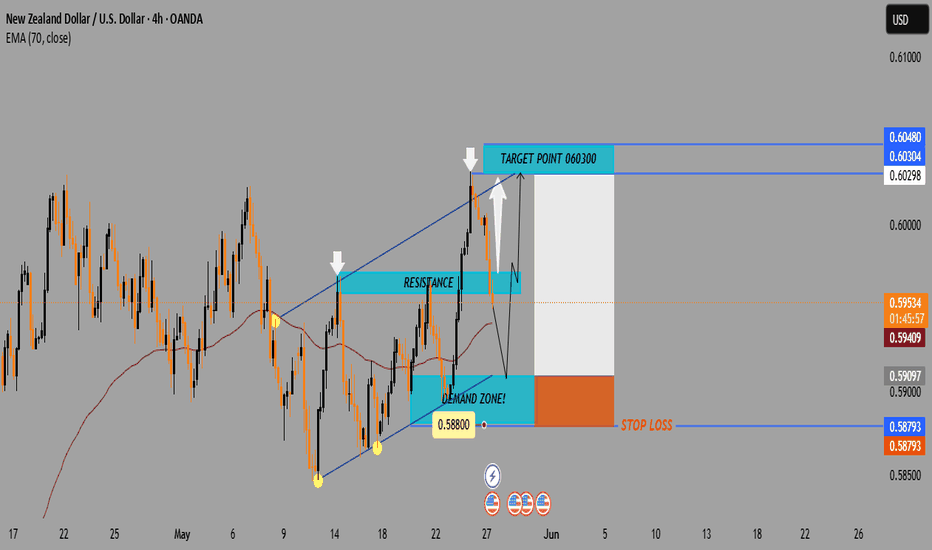

NZD/USD4H

Chart Analysis Bullish Reversal Setup from

Demand Zone📈

Price: 0.59552

📊 EMA 70: 0.59410 (🟤 Brown Line)

Chart Zones & Key Levels

🔷 Resistance Zone:

🔼 Around 0.60298 – 0.60304

🔹 Price reacted strongly here (🔽

white arrows)

🔹 Acts as a ceiling for now

🟢 Demand Zone:

🔽 Around 0.58800

✅ Buyers stepped in here before

📉 If price drops again, might

bounce f

USDJPY

Analysis – Yield Support Signals Potential

UpsideUSDJPY

is currently sitting at a key

support zone around 142.80–143.00,

showing signs of a potential bullish

reversal. This support area has

previously acted as a strong

launchpad for price rallies.

🟢 Technical Setup:

Price action has formed a clean

higher low structure, bouncing off

horizontal su

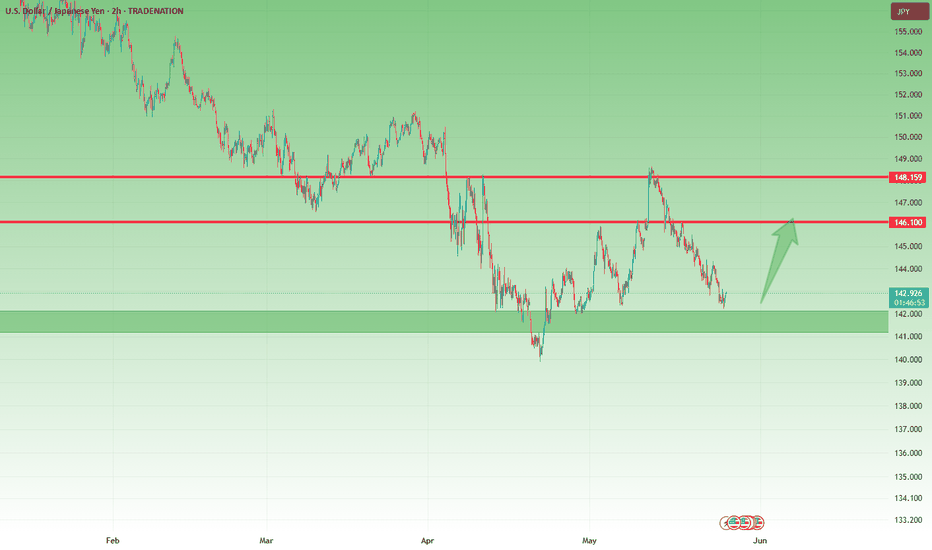

USDJPY

Returns to Key Support – Another Bounce

Ahead?At

the end of April and beginning of

May, I pointed out the importance of

the 142 support zone and argued that

USDJPY could reverse to the upside,

targeting the 146 resistance.

The pair did exactly that — not only

hitting the 146 target, but also

spiking as high as 148, reaching the

next major resi

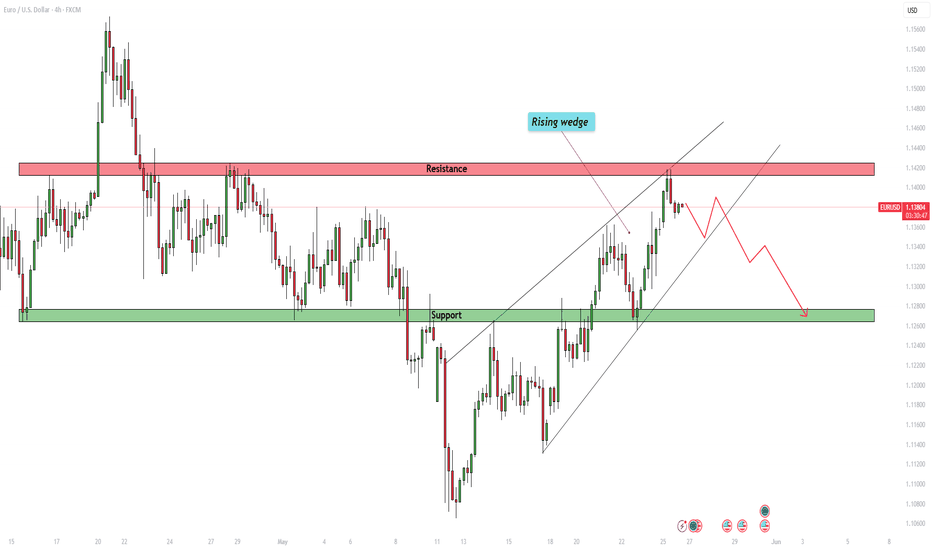

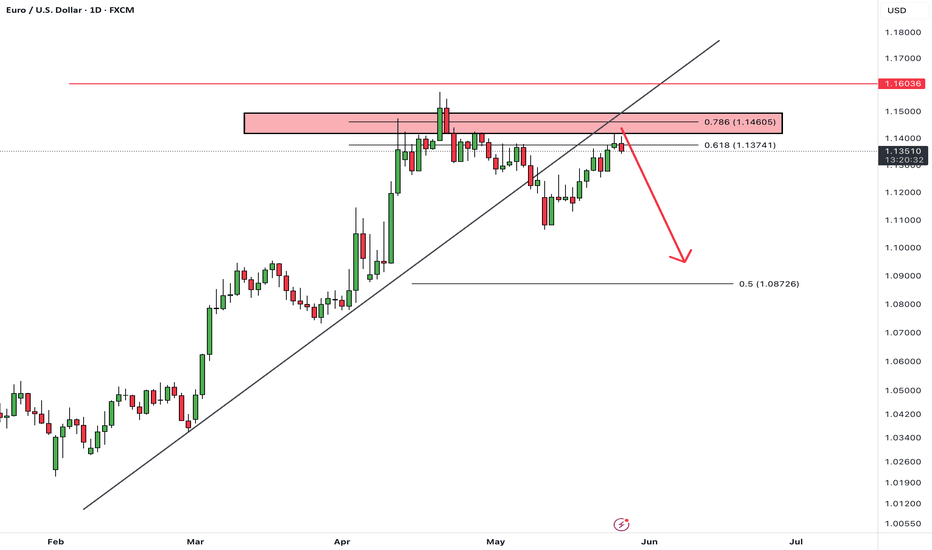

EUR/USD

- Is the uptrend about to end?The

EUR/USD currency pair has

demonstrated a consistent uptrend on

the 4-hour chart for approximately

two weeks. This sustained bullish

momentum has captured the attention

of traders and analysts alike, who

are now questioning whether the pair

can maintain its upward trajectory

or if a retracement

i

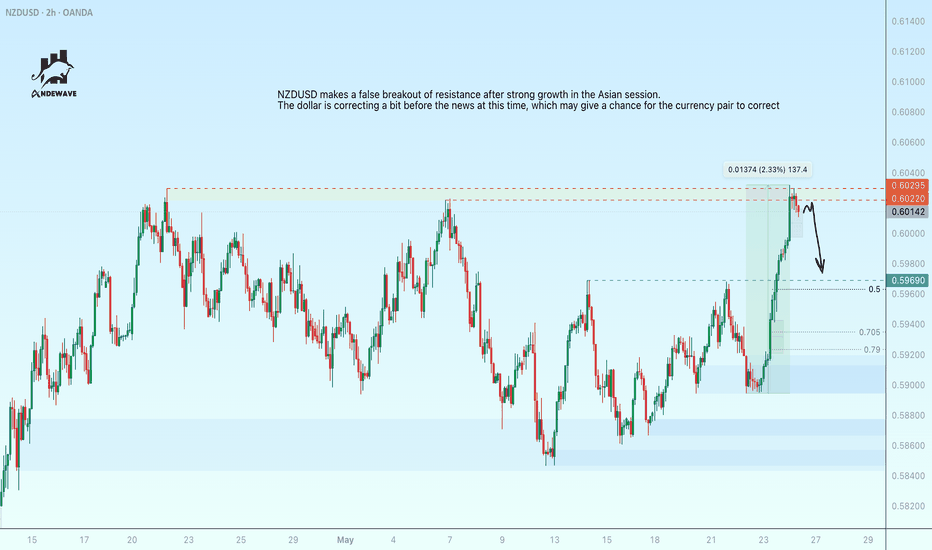

NZDUSD

- growth ended with a false breakout NZDUSD

makes a false breakout of resistance

after strong growth in the Asian

session. The dollar is correcting a

bit before the news at this time,

which may give a chance for the

currency pair to correct

Scenario: Strong growth of 2.3% is

tempered by a false breakout. The

price is not ready to

con

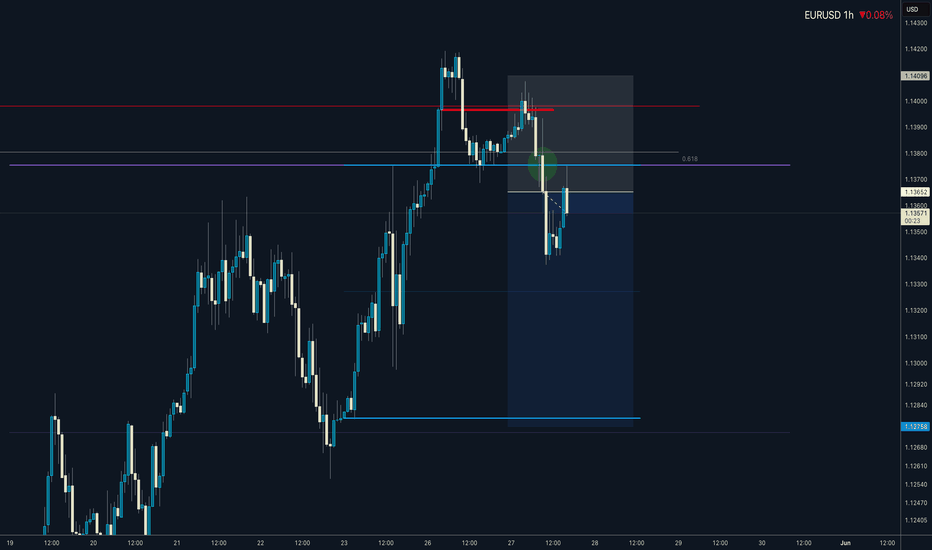

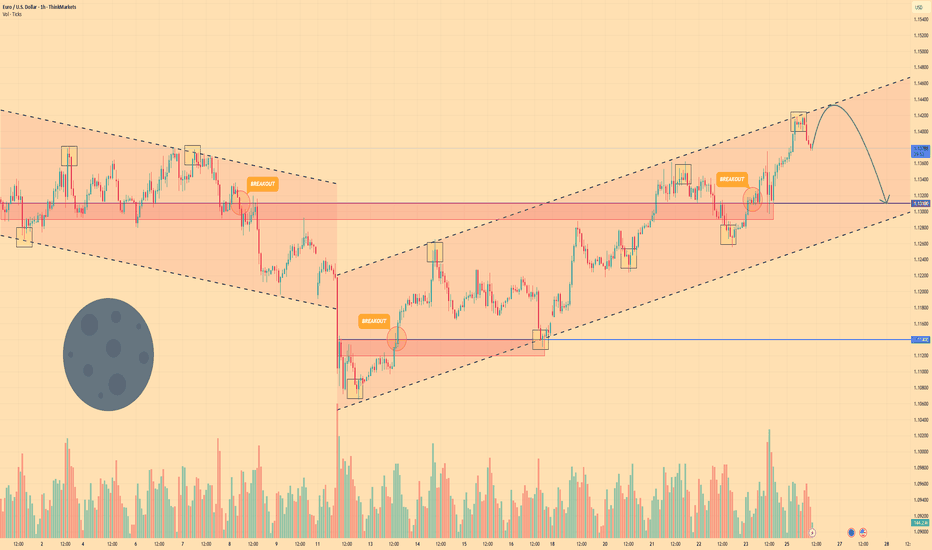

EURUSD

I Daily Weekly CLS I Model 1- 2R setupHey,

Market Warriors, here is another

outlook on this instrument

If you’ve been following me, you

already know every setup you see is

built around a CLS range, a Key

Level, Liquidity and a specific

execution model.

If you haven't followed me yet,

start now.

My trading system is completely

mech

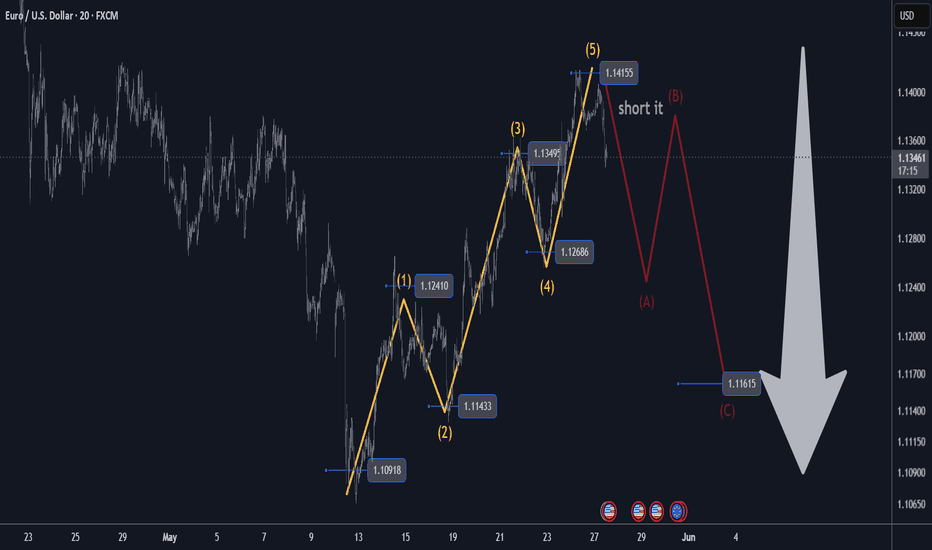

eurusd

20 short-term market update short it exit

1160🏆

EURUSD Market Update m20 short-term

trade

📊 Technical Outlook

🔸Short-term: BEARS 1160

🔸5 waves impulse completed

🔸1090/1240/1140/1350/1270/1410

🔸a/b/c/ correction 1160

🔸short sell and exit at 1160

🔸Price Target Bears: 1160

Key recent developments in EURUSD

📉 The U.S. dollar weakened as

inves

EURUSDHello

Traders! 👋

What are your thoughts on EURUSD?

EURUSD has pulled back to the broken

trendline and is now trading below a

key resistance zone.

As long as the price remains below

this resistance, we expect a

short-term decline toward the

specified support level.

The rejection from this zone

sugge

EURO

- Price can rise a little and then start to

declineHi

guys, this is my overview for

EURUSD, feel free to check it and

write your feedback in comments👊

Some time ago, price entered a

falling channel, where it broke

through $1.1310 level at once, but

soon broke it again.

Price traded near this level for

some time, after which it reached

resistance l

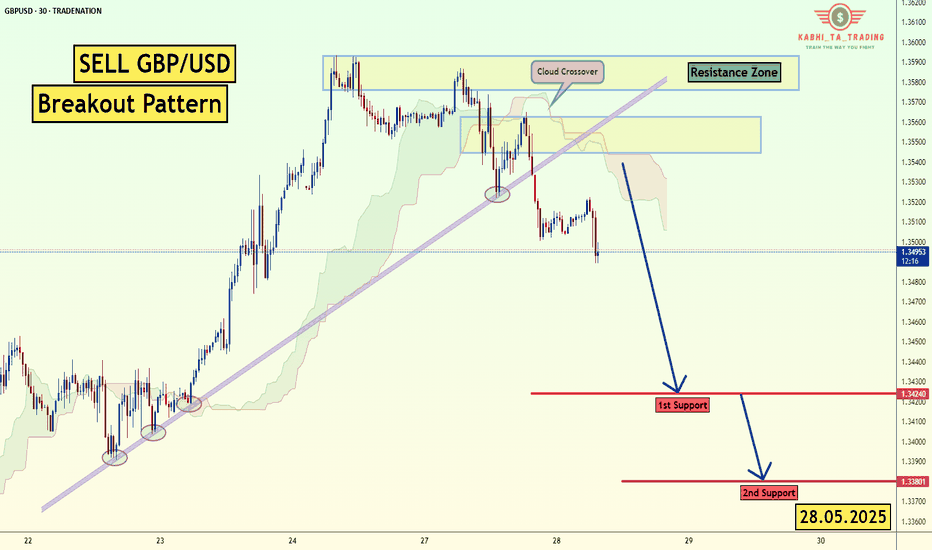

GBP/USD

Breakout (28.05.2025)The

GBP/USD Pair on the M30 timeframe

presents a Potential Selling

Opportunity due to a recent

Formation of a Breakout Pattern.

This suggests a shift in momentum

towards the downside in the coming

hours.

Possible Short Trade:

Entry: Consider Entering A Short

Position around Trendline Of The

Pat

See all forex ideas

|

−0.13%

|

0.13%

|

0.21%

|

−0.18%

|

0.22%

|

−0.22%

|

0%

|

||

|

0.14%

|

0.25%

|

0.34%

|

−0.04%

|

0.36%

|

0.01%

|

0.11%

|

||

|

−0.08%

|

−0.23%

|

0.11%

|

−0.30%

|

0.15%

|

−0.34%

|

−0.11%

|

||

|

−0.18%

|

−0.32%

|

−0.06%

|

−0.35%

|

0.05%

|

−0.40%

|

−0.23%

|

||

|

0.22%

|

0.26%

|

0.31%

|

0.43%

|

0.43%

|

−0.12%

|

0.21%

|

||

|

−0.17%

|

−0.31%

|

−0.03%

|

0.03%

|

−0.38%

|

−0.39%

|

−0.22%

|

||

|

0.22%

|

−0.01%

|

0.34%

|

0.39%

|

0.09%

|

0.47%

|

0.47%

|

||

|

0%

|

−0.05%

|

0.17%

|

0.27%

|

−0.09%

|

0.28%

|

−0.46%

|

Sign in to

read exclusive news

Sign in to

read exclusive news

Finland's

government proposes 994 million euro borrowing

increase

Sign in to

read exclusive news

How copper

market remains vulnerable to supply chain

concentration

Sign in to

read exclusive news

Sign in to

read exclusive news

Sign in to

read exclusive news

Sign in to

read exclusive news

Sign in to

read exclusive news

Sign in to

read exclusive news

Sign in to

read exclusive news

Sign in to

read exclusive news

Sign in to

read exclusive news

Sign in to

read exclusive news

Sign in to

read exclusive news

Australia

clears Woodside’s North West Shelf LNG plant to

operate through 2070

FX option

expiries for 28 May 10am New York cut

Sign in to

read exclusive news

Japanese Yen

Weakens Further

New Zealand

Dollar Rises After RBNZ Decision

South Korean

Won Slips for 3rd Session

Australian

Dollar Struggles Despite Hot Inflation Print

Sign in to

read exclusive news

Dollar Gains

0.13% to 19.2709 Mexican Pesos — Data Talk

Today

•

Dallas

Fed Services Index

Actual

20:07

Forecast

—

Prior

-19.4

Today

•

Dallas

Fed Services Revenues Index

Actual

20:07

Forecast

—

Prior

3.8

Today

•

BoE

Pill Speech

Actual

—

Forecast

—

Prior

—

Today

•

17-Week

Bill Auction

Actual

—

Forecast

—

Prior

4.23

%

Today

•

2-Year

FRN Auction

Actual

—

Forecast

—

Prior

0.16

%

Today

•

Industrial

Production YoY

Actual

—

Forecast

1.1

%

Prior

0.8

%

Today

•

PPI

MoM

Actual

—

Forecast

—

Prior

-1.5

%

Today

•

PPI

YoY

Actual

—

Forecast

—

Prior

5.9

%

See more events

Trade directly

on the supercharts through our supported, fully-verified and user-reviewed

brokers.